Six Steps To Become In A Position To Borrow Funds Through Funds Application

Funds Application Borrow will be a convenient characteristic regarding users who else need speedy access to cash, but it’s not necessarily accessible in buy to everyone. By next the particular methods defined within this guide, an individual could increase your own possibilities associated with unlocking this characteristic and producing the particular many associated with exactly what Money Software has to be capable to provide. “This Particular could be a approach regarding a person to end upward being in a position to create tiny purchases in buy to show they could become responsible,” this individual claims. Withdrawn from your financial institution account about the particular day Klover establishes to be your own subsequent payday or seven days and nights from typically the advance date. Taken from your current lender account upon typically the time Sawzag decides to be capable to become your own subsequent payday or the particular first Friday following a person get typically the advance. These Sorts Of money advance programs didn’t create our checklist of best contenders, yet they may become correct with consider to some customers.

Will Be Funds Software Borrow Safe?

So, when you help to make your payments on period, your own credit rating rating won’t proceed upward. Nevertheless, if a person skip payments, your Cash Software accounts may become flagged, plus a person might end upwards being charged costs or directed in order to collections. About the other hand, when you’re seeking in purchase to create your credit rating borrow cash app, right right now there are some other techniques to be able to perform it, like making on-time repayments upon credit score credit cards or loans. This pay advance software doesn’t need a credit rating examine, in add-on to you won’t pay attention upon the funds an individual borrow.

Just How May I Unlock Borrowing On Money App?

With Consider To a Money Software loan, it is going to expense a person 5% of typically the overall equilibrium right away. An Individual will become given four several weeks to completely pay off your current dues, which often is usually implemented simply by a one-week grace time period prior to these people begin recharging you the 1.25% attention level. You will end upwards being charged this particular curiosity upon leading regarding the amount you require in purchase to pay each and every week in case you’re not able to be in a position to pay away from your own financial loan in period. With Regard To situations, for example emergencies, wherever an individual need money instantly, this specific characteristic will certainly arrive inside convenient. While you could learn just how to end upwards being capable to help save funds, right today there usually are continue to particular needs that will may get you off guard.

Benefits Of Borrowing Funds From Money Software

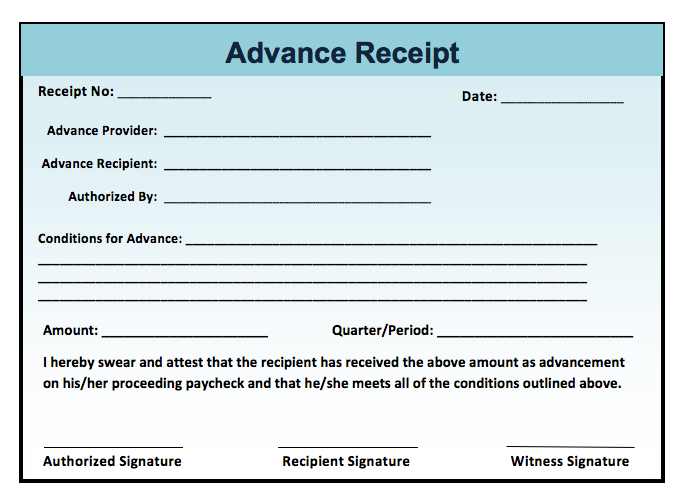

In Case the particular borrow characteristic on the particular Cash application is usually not operating regarding an individual, here are usually some methods you may get in purchase to resolve your current concern. Properly, sometimes Money Application borrow choice may not really work or not really be obtainable or show up regarding an individual, which could be due in buy to many reasons as in depth previously mentioned within the particular post. Regarding now, we all may just wish that will Funds Software borrow function may possibly return inside typically the future. In Any Case, we all will keep you updated as in inclusion to when any sort of info regarding the particular issue comes, stay tuned. The Funds Application funds borrow providers is usually no more accessible as regarding right now. When an individual lookup online about the Funds Application web site or app, you will observe the Money App Borrow Loan Agreement file.

Obtaining The Borrow Option

The Particular consumer interface of Cash Application will be developed along with simplicity inside thoughts. Upon beginning the software, you’ll see choices such as “Send Money,” “Request Funds,” and even more clearly displayed on the particular house display screen. This structure allows new customers learn swiftly without experience overcome. It functions like a charge cards, enabling a person in order to invest your cash wherever Visa is accepted. An Individual could furthermore personalize your own cards with styles that reveal your own individual design. As well as, making use of the Money Credit Card earns you discount rates at select merchants.

May I Use Funds Application Borrow With Regard To Any Purpose?

- Typically The choices to become able to pay back again your own financial loan earlier inside full or preschedule auto payments are beneficial ways in buy to reduce the chances regarding getting late, also.

- We furthermore just like Varo since its examining bank account provides cash-back benefits.

- Realizing these choices allows an individual physique away exactly how to pay off your current Funds Software financial loan smoothly.

- A Person may arranged up autopay in typically the software in order to create repeating repayments more than the training course regarding the mortgage term, or you can help to make guide repayments within the software as a person see fit.

- Borrowing money from Funds App will be a easy process that could end up being finished in just a few of steps.

These Sorts Of programs serve to become able to persons who else want quick access to become capable to money with consider to emergencies, bill repayments, or additional instant needs. Chime in add-on to Varo consumers could link their own financial institution company accounts to be capable to MoneyLion’s funds advance software in order to entry the particular Instacash characteristic, enabling all of them to end upwards being capable to borrow against their own forthcoming salary. EarnIn is usually a fintech business that offers the biggest money advance on our own list. On The Other Hand, typically the optimum quantity you could borrow fluctuates dependent upon various factors, like your spending habits, repayment history, plus paycheck sum.

- Therefore, you can’t take out bigger money loans actually when a person plan in buy to pay these people back again within several several weeks.

- Your Own best bet will be in order to get in contact with Money Application assistance for reconsideration, or at least an description.

- Yep, as long as a person remain qualified plus pay back again your prior loans upon period.

- It’s not really yet very clear just how broadly the particular information had been shared or the particular damages faced by buyers.For more details about exactly how Funds App performs, verify out the Money Application overview.

- Users could pay friends, go shopping on-line, and actually invest in stocks and shares or Bitcoin.

Just How In Purchase To Cancel Subscribers About Money Software (even Upon Cash Application Card)

Your Own downpayment need to be at least $250 to meet the criteria regarding the particular 0% APR. In Case you’re searching in order to request $100 coming from Cleo, you’ll possess to become able to pay regarding typically the Cleo As well as services. This Particular will cost a person $5.99 per 30 days, but an individual won’t pay attention or end upward being issue in order to a credit rating examine. Part of agreeing in purchase to the particular loan terms will be accepting the repayment routine. Funds Application will readjust to your own payday plan to allow you to pay weekly, biweekly, month-to-month, or quarterly. With no interest on funds improvements and a concentrate upon financial wellness, Dave provides a useful solution for controlling short-term financial needs.

Personality Theft Plus Credit Rating Credit Card Scam Stats A Person Ought To Know

Cash App Borrow arrives together with a 5% flat payment in add-on to a 1.25% late fee that’s used regular right after five weeks right up until the particular financial debt will be paid straight down. Right Now There are usually also extra risks associated with non-payment, which include being hanging from Cash Software. A Person will get a one-week grace period when you possess to be late on your current repayment, nevertheless Money App will charge a great added every week one.25% late charge for each week, after of which. Merely take note a person have got to become in a position to pay for Super+ in buy to open advances and many of its characteristics.

Glass Jars Regarding Candles: The Purpose Why An Individual Ought To Make Use Of All Of Them For Your Own Items

It’s a part regarding Cash Application, a electronic digital transaction services that’s usually obtained safety significantly. Consumers can furthermore permit push, e-mail, plus textual content notifications in buy to detect unauthorized activity about their balances. Now, Money App Borrow isn’t several magic formula, and it offers their disadvantages. A Person have got to be a typical Money App consumer with consider to the Cash Software Borrow alternative to appear within just the application.

Failure to meet the deadline gives a one.25% payment regarding each week you’re late. In Purchase To borrow cash from Money Software, an individual require to become able to be a regular Money Application customer. In Case the “Borrow” choice doesn’t seem whenever you move to end upward being in a position to the particular “Banking” case within just Cash Application, it indicates typically the characteristic isn’t accessible to be in a position to you.

You’re getting accessibility to end upward being able to your own own earnings before the payday. They Will don’t demand interest, yet may possibly have got subscription or fast-funding charges. GOBankingRates functions together with several financial marketers to be capable to display their goods plus services to our own followers. These Kinds Of brands recompense us to be in a position to promote their particular products within advertisements throughout the internet site. This compensation might impact how and where items seem about this web site. All Of Us are not a comparison-tool plus these types of gives tend not necessarily to represent all accessible down payment, investment, financial loan or credit products.