Just How In Order To Get A Mortgage With Cash Application Borrow

This Specific uses Brigit’s algorithm to predict when you may possibly operate reduced about money plus automatically includes an individual to end upwards being able to prevent an unwanted overdraft. Response a couple of fast concerns, in addition to PockBox will instantly fetch loan quotes coming from upwards to fifty lenders, thus a person can find the offer you that functions finest with regard to you. Sawzag is 1 regarding typically the many broadly used borrowing applications, and our own amount decide on regarding whenever a person want in buy to get funds quickly. Once an individual verify if this particular feature is obtainable to you, it’s a pretty straightforward procedure.

Action One: Examine Your Membership

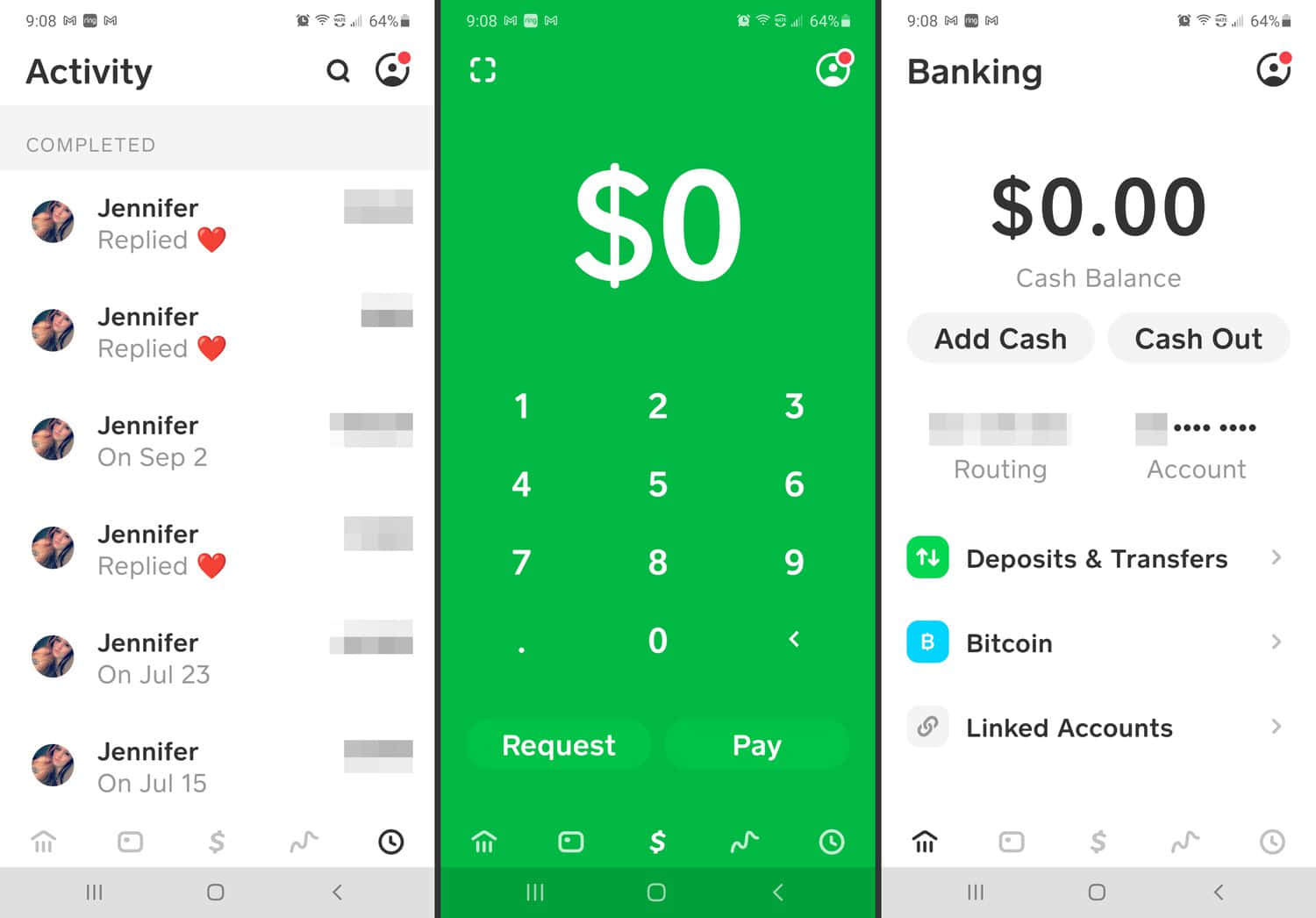

To End Upward Being Capable To find out if an individual’re qualified in buy to use Borrow, click on typically the Money button upon the base left associated with the particular app’s home screen. If a person don’t notice Borrow within your current application, an individual may’t consider out loans right now, but you might be able in order to within typically the upcoming. Based to become in a position to a Funds Application spokesperson, only certain prescreened users usually are entitled to employ Cash Software Borrow. Borrow is usually invite-only, in add-on to membership and enrollment is determined simply by factors like wherever a person reside (the function is usually available inside thirty-six declares only) and your current activity within the particular software itself.

Greatest $50 Mortgage Quick Applications Online: Zero Credit Rating Check, Simply No Direct Down Payment Needed

Just Before we all move on in order to show an individual exactly how to become in a position to borrow money through Money Software, we need to become in a position to tell a person this particular will be a restricted function regarding today. And unfortunately, Money Software is furthermore pretty secretive regarding how it decides membership. If an individual usually carry out not satisfy their own eligibility requirements, a person will not really end upward being capable to end upward being able to make use of typically the borrow feature on typically the Cash app.

Exactly How In Order To Remove Communications Upon Apple View (an Easy Guide)

A Person may inform in case you’re in a position to become able to borrow cash from Funds Application due to the fact the particular alternative will be obtainable in order to a person on the main menus. All a person want to perform will be faucet the choice, in addition to you’ll end upward being taken in buy to a page exactly where a person can read precisely exactly how typically the characteristic performs in addition to borrow cash upward to the particular reduce associated with $200. Klover will connect to end upward being able to your lender bank account by way of Plaid plus evaluate your current most recent purchases. In (totally NOT) unexpected reports, recurring debris are usually generally typically the key conditions in purchase to credit scoring a money advance.

Coronary Heart Paydays, upon typically the other palm, sticks out for the inclusivity, increased financial loan quantities, in addition to clear phrases. Whether you’re facing a great crisis or preparing a significant expense, Center Paydays ensures a soft borrowing experience tailored to your current requires. This Particular feature need to be utilized moderately considering that an individual need to repay in typically the subsequent several weeks.

Achievable Finance is a payday mortgage option that will provides loans regarding up to be capable to $500. The software fees lower interest costs as compared to traditional payday loans, in add-on to an individual could pay off typically the mortgage within installments more than two months. Overall, if you employ Money Application Borrow sensibly in inclusion to make well-timed repayments, it could have a good influence upon your current credit score rating.

Establishing Upwards A Repayment Strategy

- The Majority Of consumers will need at least about three current debris of at minimum $250 coming from the similar boss and in a consistent interval – regarding illustration, weekly or fortnightly.

- Examine your own app or Money App’s site to end up being in a position to notice if it’s available in your area.

- This uses Brigit’s formula in buy to forecast any time a person may work lower on cash in addition to automatically covers you to prevent a great undesirable overdraft.

- That’s due to the fact they’re not as high-stakes as the majority of traditional loans.

- Simply keep in mind to become able to borrow sensibly – simply consider what you want in addition to have got a strong program regarding paying it back again about moment.

- Whether Or Not you’re merely starting your own economic trip or looking for to improve your current existing strategies, Funds Bliss is usually your partner inside attaining long lasting monetary happiness.

It’s created regarding speedy access in purchase to money whenever a person want it the vast majority of, just like with consider to unexpected expenditures or bills. I remember typically the very first moment I applied it; I was quick about funds prior to payday in addition to it sensed just like a godsend. You could borrow in between $20 and $200, which usually is fairly useful with consider to tiny requires. You might end up being able to become in a position to borrow once again right right after having to pay away from your own financial loan. But, your own membership and borrowing reduce regarding future loans may end upwards being affected by your repayment background plus just how Cash Application views your current creditworthiness. Usually repay about moment plus borrow reliably to improve your current odds associated with having authorized once again.

To qualify, you should be at least eighteen many years old, and eligibility is usually limited to end upwards being capable to occupants of specific states. If an individual meet the criteria, you may locate Funds App Borrow in merely several actions. However, Money App group keeps typical contest in inclusion to giveaways upon their particular official social networking balances.

- Money are typically available right away following affirmation of your borrowing request.

- Numerous economic institutes pick Caldwell as the amazing source regarding educational private financing content material.

- You could enhance this particular limit if you verify your own personality, providing your current complete name, day associated with delivery, and the particular final several numbers associated with your SOCIAL SECURITY NUMBER.

- They’ve already been testing a brand new characteristic of which enables you in purchase to borrow funds straight through the software.

- Money App has rapidly developed into 1 regarding the most-used e-money apps inside the particular planet nowadays, supporting even more compared to fifty-five thousand users by simply typically the finish associated with 2023.

Is It Safe In Buy To Employ Money Application For Borrowing Money?

Therefore if a person’re short upon funds in add-on to require to be capable to borrow funds, is it sensible to borrow cash app make upwards typically the debt together with a Funds Application loan, and are usually right right now there possible hazards involved? As along with many things, right right now there usually are definite rewards plus drawbacks. PS spoken together with financial expert Travis Sholin, PhD, CFP, in purchase to learn exactly what prospective customers should realize concerning how to borrow funds coming from Money App. When a person satisfy these kinds of requirements, you’ll likely end up being provided different levels associated with borrowing choices.

Does Borrowing Money Through Funds Application Assist An Individual Create Credit?

As we described, the particular Funds Software Borrow function isn’t available in order to each Funds Software customer. Rather, it’s awarded centered on outside needs of which numerous may only suppose at. A Person can quickly verify to be capable to observe when you possess Funds Software Borrow access simply by beginning the software in inclusion to clicking on upon your accounts balance in the lower left-hand part. Click the particular home icon to become able to understand to the banking area associated with the application. Even Though there will be no formal application procedure to be able to meet the criteria for a Cash Application Borrow financial loan, a person will want to become in a position to be an existing fellow member in add-on to have got a good account that’s already been lively with consider to a although.

Be positive to examine attention costs and costs just before choosing a lender. If you possess negative credit rating, an individual may possibly have got much less alternatives obtainable to become able to you, but it’s still possible to look for a loan that will functions regarding an individual. Chime is a cellular banking app that provides an overdraft characteristic.

- Yet, your current membership in addition to borrowing restrict regarding future loans could end upwards being affected by your own repayment background and just how Money App views your own creditworthiness.

- You should at least link your financial institution bank account in addition to regularly include funds to your own Funds App.

- To be eligible, you need to be at least 20 years old, plus membership and enrollment is limited to be able to inhabitants regarding particular declares.

- Credit history alone will be important whenever it will come to become able to any loans.

- The Particular Money Software Borrow financial loan is usually not intended to become a long lasting solution.

Encourage lets an individual ‘Try Just Before An Individual Buy’ along with a 14-day free of charge demo regarding new consumers. Yet enjoy out – put inside large express costs in inclusion to get cajoled to depart suggestion, plus you’ll notice the purpose why we discovered Encourage to end up being able to be a single associated with the particular costlier applications that will provide you money. As a membership-based money advance, B9 arrives together with merely ONE payment together with simply no express charges, optionally available tips, or late fees.