EarnIn implies a tip centered on your own drawback sum, but tipping is entirely optional plus doesn’t impact your current membership for upcoming entry. No-fee transactions usually are available yet you’ll want a ‘Friday Card’ that is just accessible along with immediate debris to end upward being in a position to a DailyPay accounts. The Particular app is NOT a paycheck advance in add-on to you won’t ever before be being able to access funds a person don’t have. With the particular DailyPay software, you may entry attained wages of which you’ve currently worked well with regard to – so you’re not obtaining a standard financial loan. The Klover Android os app allows an individual accessibility upward in order to $200 funds advances together with no costs or attention – also if your own payday is up in purchase to 2 weeks away.

Varo

Albert’s cash advance services is usually known as Instant plus essentially performs as overdraft protection up to $250. Intelligent Money analyzes your current shelling out plus makes investment or financial savings debris based upon your own allocations, which a few customers may not necessarily need. A Person can, on another hand, switch off Smart Money whenever a person aren’t using Quick. While many cash advancements top out at $250 to become able to $500, Beem provides improvements up to end upwards being in a position to $1,000 regarding qualified users. Immediate exchanges — which show up inside something just like 20 mins — only price $1 to $4, which will be comparatively inexpensive in comparison to end upwards being in a position to additional apps. To decide which sort of loan to consider, we appearance at reliable companies just, their attention rates in addition to general terms, alongside with the sum they will can borrow.

Debt Loan Consolidation Calculator: Estimate Your Own Savings

You can transfer funds among Present in add-on to PayPal, yet you are not capable to employ PayPal to end upward being capable to entry Current’s funds advance support. A Person may find out more about some other choices in our list regarding typically the finest money advance applications. A Few payday advance apps likewise offer cost management tools to assist you monitor in addition to handle your spending or computerized financial savings tools to be capable to assist an individual build upward your unexpected emergency fund. Many likewise provide methods to become in a position to aid a person make extra funds via cash-back benefits, additional shifts, or part gigs. It doesn’t help to make your current limited paycheck extend any further this particular month compared to it did previous 30 days.

Greatest For Quick Money Together With A Low Fee

A Person can take into account alternatives like MoneyLion Instacash, Albert Instant in addition to Enable also. While other financial savings company accounts might possess lower APYs, most don’t cover just how a lot an individual could generate. Current isn’t a great option when you’re keeping a substantial sum in cost savings. Nimble AppGenie is usually a major mobile application development organization with a range regarding well-known cell phone application development providers and proven successes with regard to our own consumers. He is a highly encouraged person who allows SMEs plus startups grow in this specific active market together with the most recent technological innovation in addition to innovation. This program will be but one more instance associated with a good employee-employer cash advance arrangement.

These Varieties Of relationships usually carry out not influence our views or recommendations. Amounts you maintain together with nbkc bank, which includes nevertheless not limited in order to bills placed in Enable accounts, are covered by insurance upward to become able to $250,500 via nbkc bank, Member FDIC. Apps on this particular list may become current or previous FinanceBuzz companions, in inclusion to this checklist doesn’t symbolize all applications obtainable on typically the market. In Case you’re looking regarding techniques in purchase to reduce your current bills, go through our Rocket Money overview to find out about a reliable choice. There’s zero fee regarding this particular support, but a person could add a “tip” of up to become able to $14. Some even choose to become able to “pay it ahead,” purposely departing a larger suggestion in purchase to include the price with respect to those who can’t afford it.

- Traditional options, like payday loans or credit credit card cash advancements, may seem to be such as a fast repair, nevertheless these people usually appear together with high costs and attention rates.

- Varo gives money improvements up to become capable to $500 (or up in buy to $250 for brand new users), and you don’t require in order to pay a month to month fee to become entitled for advances.

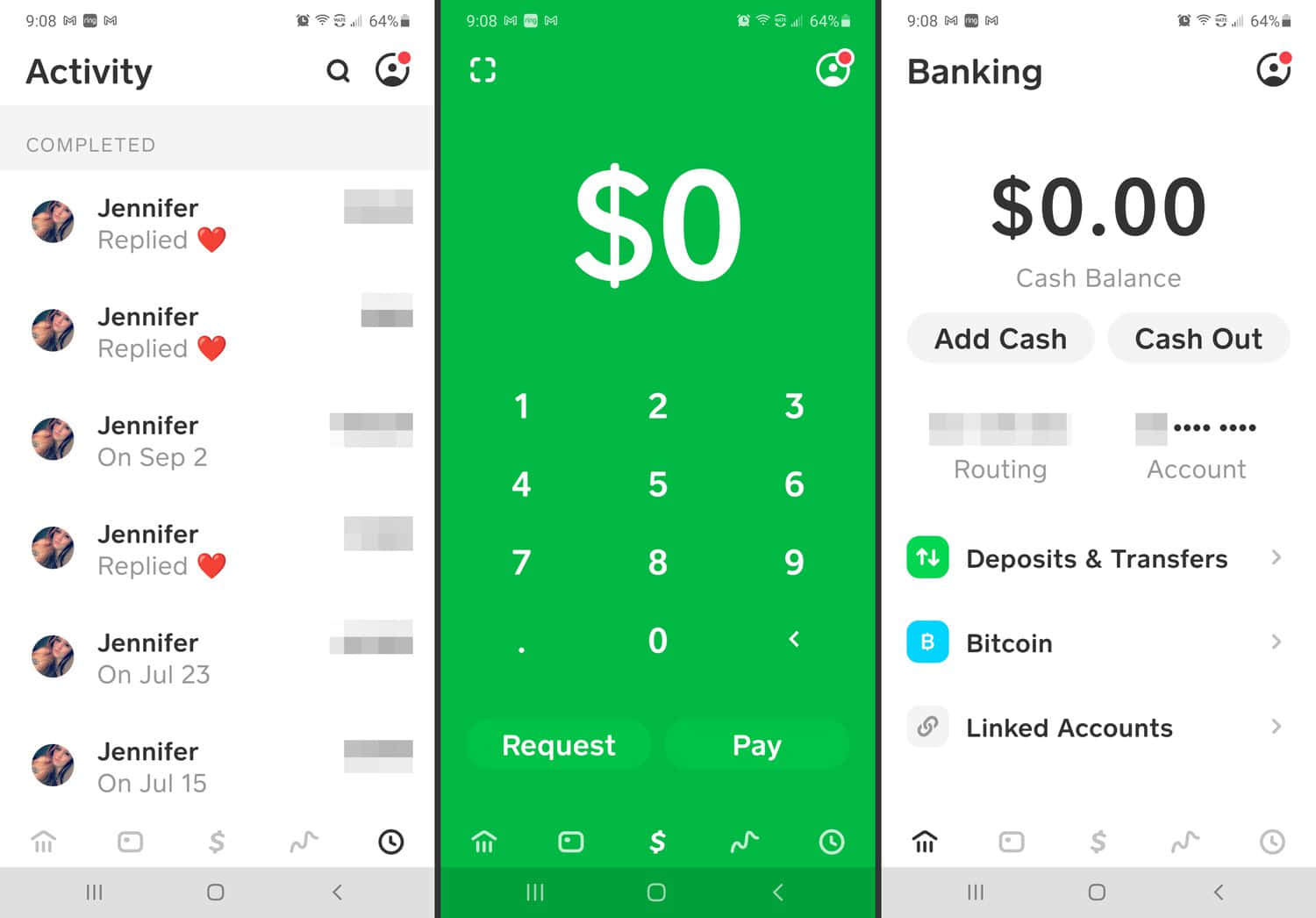

- In Case your current account will be qualified, you could temporarily obtain $200 from Money Application simply by choosing typically the “Borrow” alternative.

- Whether it’s a good unexpected bill, a great unexpected emergency obtain, or merely a little extra in order to bridge the particular distance till payday, Beem can make cash advances accessible and simple to become able to control for all those within need.

- It permits customers together with qualifying continuing direct build up to consider a cash advance of upwards in buy to $500 within mins along with a fee or one to five company days with respect to zero payment.

What Application Permits Me To Borrow Funds Instantly?

In Contrast To cash borrowing app several additional apps, Chime doesn’t acknowledge suggestions regarding its cash advance function, in add-on to typically the $2 fee in buy to obtain your current money quickly will be very much lower than what competitors demand. Albert will be a single of the particular finest funds advance apps that will work with Funds App. An Individual might actually become able in buy to get free of charge funds on Funds Application with a good Albert lender bank account. In Case an individual need cash today, after that this money advance app may keep typically the response to end up being able to your current prayers.

This Specific may effect which usually products we write concerning and wherever and how they seem about the web page. Nevertheless, views indicated right here are usually typically the author’s alone, not necessarily those associated with any type of bank, credit credit card issuer, air travel or hotel cycle. We’ve explored the best money apps to be able to borrow money and produced our checklist regarding top selections. Yet you need to have a month-to-month membership to meet the criteria regarding advances through Beem, plus a person’ll require typically the Pro plan, at $12.ninety-seven a 30 days, if an individual need advancements associated with more as in contrast to $100. Nevertheless, in buy to calculate your own hours, a person’ll want to concur to become capable to GPS tracking, provide your own function email or upload your current timesheet. Within my expert encounter, the particular most common risk regarding using a taxes reimbursement advance mortgage is a hold off within typically the real reimbursement from typically the IRS.

- The Particular next period an individual require an advance, an individual don’t have got in buy to be concerned about opening a brand new lender bank account or finding a method to be able to get funds or overdraft protection.

- We are in a position to be able to present this particular info to be capable to a person free regarding demand due to the fact a few regarding the particular companies showcased on our site recompense us.

- A cycle of financial debt will be when you continue to consider upon more debt than you may pay off.

- Albert stands out like a leading selection since it gives instant money advances upwards to end upwards being capable to $250 plus works with seamlessly with Money Application.

Somewhat this system has combined with a amount regarding US banking institutions to deliver seamless cell phone banking providers. Plus as it will go with respect to funds advance loans, presently there usually are no credit score bank checks or required costs bothering you. Cash advance applications may possibly appear just like payday loans, yet they will aren’t the particular similar. These People furthermore are not really issue in purchase to the regulations payday lenders should stick to. Nevertheless, the particular premise will be related as these people the two are usually little loans of which require repayment by simply your current subsequent payday. Sawzag provides a function known as, Sawzag ExtraCash, that permits a person to obtain upward to end upwards being capable to $500 instantly together with no curiosity, credit rating checks, or late costs.

This Specific uses Brigit’s algorithm to predict when you may possibly operate reduced about money plus automatically includes an individual to end upwards being able to prevent an unwanted overdraft. Response a couple of fast concerns, in addition to PockBox will instantly fetch loan quotes coming from upwards to fifty lenders, thus a person can find the offer you that functions finest with regard to you. Sawzag is 1 regarding typically the many broadly used borrowing applications, and our own amount decide on regarding whenever a person want in buy to get funds quickly. Once an individual verify if this particular feature is obtainable to you, it’s a pretty straightforward procedure.

Action One: Examine Your Membership

To End Upward Being Capable To find out if an individual’re qualified in buy to use Borrow, click on typically the Money button upon the base left associated with the particular app’s home screen. If a person don’t notice Borrow within your current application, an individual may’t consider out loans right now, but you might be able in order to within typically the upcoming. Based to become in a position to a Funds Application spokesperson, only certain prescreened users usually are entitled to employ Cash Software Borrow. Borrow is usually invite-only, in add-on to membership and enrollment is determined simply by factors like wherever a person reside (the function is usually available inside thirty-six declares only) and your current activity within the particular software itself.

Greatest $50 Mortgage Quick Applications Online: Zero Credit Rating Check, Simply No Direct Down Payment Needed

Just Before we all move on in order to show an individual exactly how to become in a position to borrow money through Money Software, we need to become in a position to tell a person this particular will be a restricted function regarding today. And unfortunately, Money Software is furthermore pretty secretive regarding how it decides membership. If an individual usually carry out not satisfy their own eligibility requirements, a person will not really end upward being capable to end upward being able to make use of typically the borrow feature on typically the Cash app.

Exactly How In Order To Remove Communications Upon Apple View (an Easy Guide)

A Person may inform in case you’re in a position to become able to borrow cash from Funds Application due to the fact the particular alternative will be obtainable in order to a person on the main menus. All a person want to perform will be faucet the choice, in addition to you’ll end upward being taken in buy to a page exactly where a person can read precisely exactly how typically the characteristic performs in addition to borrow cash upward to the particular reduce associated with $200. Klover will connect to end upward being able to your lender bank account by way of Plaid plus evaluate your current most recent purchases. In (totally NOT) unexpected reports, recurring debris are usually generally typically the key conditions in purchase to credit scoring a money advance.

Coronary Heart Paydays, upon typically the other palm, sticks out for the inclusivity, increased financial loan quantities, in addition to clear phrases. Whether you’re facing a great crisis or preparing a significant expense, Center Paydays ensures a soft borrowing experience tailored to your current requires. This Particular feature need to be utilized moderately considering that an individual need to repay in typically the subsequent several weeks.

Achievable Finance is a payday mortgage option that will provides loans regarding up to be capable to $500. The software fees lower interest costs as compared to traditional payday loans, in add-on to an individual could pay off typically the mortgage within installments more than two months. Overall, if you employ Money Application Borrow sensibly in inclusion to make well-timed repayments, it could have a good influence upon your current credit score rating.

Establishing Upwards A Repayment Strategy

- The Majority Of consumers will need at least about three current debris of at minimum $250 coming from the similar boss and in a consistent interval – regarding illustration, weekly or fortnightly.

- Examine your own app or Money App’s site to end up being in a position to notice if it’s available in your area.

- This uses Brigit’s formula in buy to forecast any time a person may work lower on cash in addition to automatically covers you to prevent a great undesirable overdraft.

- That’s due to the fact they’re not as high-stakes as the majority of traditional loans.

- Simply keep in mind to become able to borrow sensibly – simply consider what you want in addition to have got a strong program regarding paying it back again about moment.

- Whether Or Not you’re merely starting your own economic trip or looking for to improve your current existing strategies, Funds Bliss is usually your partner inside attaining long lasting monetary happiness.

It’s created regarding speedy access in purchase to money whenever a person want it the vast majority of, just like with consider to unexpected expenditures or bills. I remember typically the very first moment I applied it; I was quick about funds prior to payday in addition to it sensed just like a godsend. You could borrow in between $20 and $200, which usually is fairly useful with consider to tiny requires. You might end up being able to become in a position to borrow once again right right after having to pay away from your own financial loan. But, your own membership and borrowing reduce regarding future loans may end upwards being affected by your repayment background plus just how Cash Application views your current creditworthiness. Usually repay about moment plus borrow reliably to improve your current odds associated with having authorized once again.

To qualify, you should be at least eighteen many years old, and eligibility is usually limited to end upwards being capable to occupants of specific states. If an individual meet the criteria, you may locate Funds App Borrow in merely several actions. However, Money App group keeps typical contest in inclusion to giveaways upon their particular official social networking balances.

- Money are typically available right away following affirmation of your borrowing request.

- Numerous economic institutes pick Caldwell as the amazing source regarding educational private financing content material.

- You could enhance this particular limit if you verify your own personality, providing your current complete name, day associated with delivery, and the particular final several numbers associated with your SOCIAL SECURITY NUMBER.

- They’ve already been testing a brand new characteristic of which enables you in purchase to borrow funds straight through the software.

- Money App has rapidly developed into 1 regarding the most-used e-money apps inside the particular planet nowadays, supporting even more compared to fifty-five thousand users by simply typically the finish associated with 2023.

Is It Safe In Buy To Employ Money Application For Borrowing Money?

Therefore if a person’re short upon funds in add-on to require to be capable to borrow funds, is it sensible to borrow cash app make upwards typically the debt together with a Funds Application loan, and are usually right right now there possible hazards involved? As along with many things, right right now there usually are definite rewards plus drawbacks. PS spoken together with financial expert Travis Sholin, PhD, CFP, in purchase to learn exactly what prospective customers should realize concerning how to borrow funds coming from Money App. When a person satisfy these kinds of requirements, you’ll likely end up being provided different levels associated with borrowing choices.

Does Borrowing Money Through Funds Application Assist An Individual Create Credit?

As we described, the particular Funds Software Borrow function isn’t available in order to each Funds Software customer. Rather, it’s awarded centered on outside needs of which numerous may only suppose at. A Person can quickly verify to be capable to observe when you possess Funds Software Borrow access simply by beginning the software in inclusion to clicking on upon your accounts balance in the lower left-hand part. Click the particular home icon to become able to understand to the banking area associated with the application. Even Though there will be no formal application procedure to be able to meet the criteria for a Cash Application Borrow financial loan, a person will want to become in a position to be an existing fellow member in add-on to have got a good account that’s already been lively with consider to a although.

Be positive to examine attention costs and costs just before choosing a lender. If you possess negative credit rating, an individual may possibly have got much less alternatives obtainable to become able to you, but it’s still possible to look for a loan that will functions regarding an individual. Chime is a cellular banking app that provides an overdraft characteristic.

- Yet, your current membership in addition to borrowing restrict regarding future loans could end upwards being affected by your own repayment background and just how Money App views your own creditworthiness.

- You should at least link your financial institution bank account in addition to regularly include funds to your own Funds App.

- To be eligible, you need to be at least 20 years old, plus membership and enrollment is limited to be able to inhabitants regarding particular declares.

- Credit history alone will be important whenever it will come to become able to any loans.

- The Particular Money Software Borrow financial loan is usually not intended to become a long lasting solution.

Encourage lets an individual ‘Try Just Before An Individual Buy’ along with a 14-day free of charge demo regarding new consumers. Yet enjoy out – put inside large express costs in inclusion to get cajoled to depart suggestion, plus you’ll notice the purpose why we discovered Encourage to end up being able to be a single associated with the particular costlier applications that will provide you money. As a membership-based money advance, B9 arrives together with merely ONE payment together with simply no express charges, optionally available tips, or late fees.

Sure, a person will want to end upwards being capable to help to make repeating deposits in purchase to the bank account, but not really immediate deposits. Cash advance applications allow a person to get a tiny advance upon your current subsequent paycheck, a lot just like a payday financial loan, without having extreme costs. Nevertheless, cash advance apps frequently possess costs, therefore compare apps prior to having an advance to figure out your finest choice. It’s furthermore important in purchase to notice of which a few funds advance applications won’t identify Funds Application as a verifiable lender accounts, actually if your current income will be directly deposited. Rather, you’ll possess to find a more traditional route to be able to show your current optimistic bank accounts background. Cleo gives a 24-hour air conditioning away period in between loans, which usually means an individual could acquire a new advance merely a single day time after having to pay off your prior advance.

Credit Score Score

Nevertheless when you do land a career down the particular collection, possibilities usually are you’ll increase your current cash advance limit which often could ascend upwards in order to $250. The Vast Majority Of programs just like Empower impose rigid eligibility needs, nevertheless Enable has less skills, generating it easier regarding people, freelancers, in addition to gig workers to borrow fast money. EarnIn’s Balance Safeguard automatically improvements $100 when your current lender equilibrium goes under a particular restrict. An Individual can likewise keep track of your current VantageScore with respect to free of charge along with typically the incorporated credit supervising services. MarketWatch Manuals might receive settlement through businesses that will show up on this particular web page.

Leading Funds Advance Programs With No Credit Check In 2025

We All try to end up being in a position to offer up to date information, but create no warranties regarding the particular accuracy regarding our info. FinanceBuzz would not offer credit cards or virtually any some other financial products. Perhaps typically the best alternative in buy to a comparatively little money advance will be in the quick term growing your own revenue.

Exactly Why Will Be Enable A Great Option?

Money advance applications provide you entry in order to money just before your current payday, giving a more inexpensive alternate to traditional lender overdraft solutions, which usually often arrive with high charges. Rather regarding relying about high-interest loans, these apps use voluntary tips or flat charges as a earnings source. Typically The subsequent period an individual require a great advance, a person don’t have got in purchase to be concerned concerning starting a fresh lender account or finding a approach to end up being in a position to obtain funds or overdraft coverage. Instead, you may employ your own Funds Software and many cash advance applications to end upwards being capable to create comes to an end satisfy.

Also though presently there aren’t virtually any late costs, this specific may possibly business lead to become in a position to a lowered borrowing limit. As a person build trust by means of on-time repayments, an individual could enjoy your own borrowing threshold rise. Plaid is built directly into most associated with these kinds of programs, plus works as a protected bridge in between your lender in add-on to the particular cash advance software. By Implies Of Plaid, these types of apps could look at your current banking data, making sure a speedy confirmation process.

Great With Consider To Cost Management Equipment: Brigit And Enable

- If you possess a highly set up lender accounts plus obtain paid out frequently, you’ll possess typically the best odds regarding qualifying for higher borrowing limitations proper out associated with typically the gate.

- Dork provides funds advancements of upwards to $500 (though very few users meet the criteria for sums over $100), in inclusion to contains a month-to-month subscription charge associated with $1.00.

- Encourage reports these types of payments to be capable to typically the credit bureaus, so it’s a possibility to become in a position to obtain a much better credit rating report together with a strong repayment background.

- Believe associated with these people being a financial safety web, not really a typical component of your own month-to-month spending budget.

- Present will be a cell phone banking system that provides their very own banking solutions.

These Types Of could end upward being discovered upon the Money tab upon your current Funds Application residence screen. Being Able To Access funds early on will be a slippery slope, in add-on to I don’t motivate it. On One Other Hand, some of the particular above choices show up relatively low-cost if a person must use these people within a one-off bind. Money advancements are free of charge plus possess simply no charges, nevertheless a person may wait around upwards to become able to five enterprise days. If you need instant funds, you can select Turbo delivery regarding a charge.

- Dave permits an individual to borrow up to end up being in a position to $500 when a person satisfy membership and enrollment specifications.

- Whilst EarnIn offers several of typically the largest advances between money advance applications, not really all customers usually are eligible with respect to typically the highest borrowing restrictions.

- Typically The settlement might influence exactly how, exactly where plus within just what order products show up, however it will not effect the particular advice typically the editorial staff gives.

- Occasionally, the $100 or $250 limit about payday advance programs isn’t sufficient to be able to include all your own costs.

- Maintain within mind that will every disbursement is usually limited to $100 at a period, no matter of your total Instacash borrowing limit.

Could An Individual Get Apart From A Equilibrium Transfer Fee?

Getting a cash advance can save an individual coming from a lot associated with problems in add-on to charges if you don’t have got a good crisis fund in purchase to touch directly into. When your own emergency is usually a one-time factor in addition to the particular quantity is usually little, think about inquiring someone close up in order to an individual in case an individual may borrow the money. End Up Being positive a person arranged very clear conditions regarding repayment thus right today there are no misconceptions or hard feelings.

While right right now there is simply no APR on funds improvements, you must pay a $1 monthly administrative charge whether or not necessarily an individual get advances. Funds advances carry charges in addition to fees such as borrow cash app any additional financial loan or credit card. Cash Software costs a 5% purchase fee with regard to every funds advance but does not charge curiosity or late costs. This Particular implies a $100 funds advance will get a $5 payment, decreasing the internet amount acquired to be in a position to $95. A funds advance will be a purchase that will allows an individual to receive funds through a lender inside advance associated with upcoming inbound cash.