Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Upon receiving the machine and realizing how outrageously impractical their impulse i filed an irs return with the wrong social security number buy was, they sent it back. Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Return of Merchandise Sold on Account

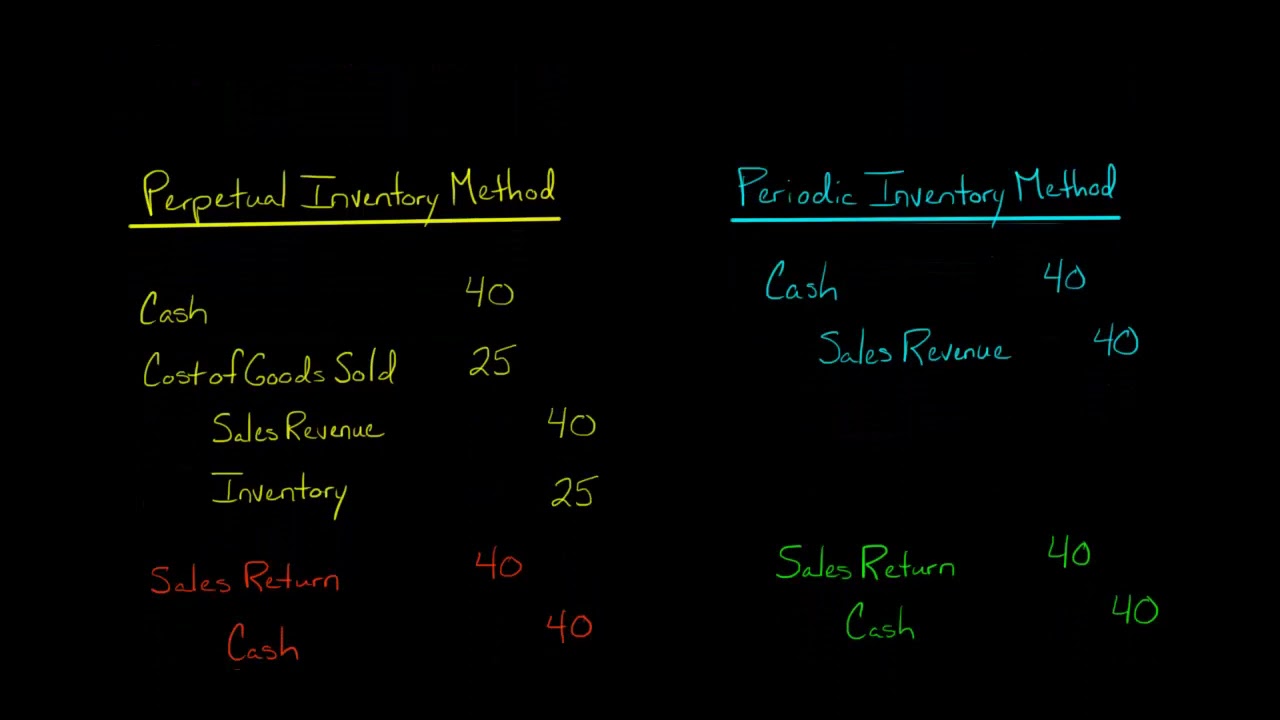

Sales returns and allowances is a contra revenue account with a normal debit balance used to record returns from and allowances to customers. The account, therefore, has a debit balance that is opposite the credit balance of the sales account. To reverse the return’s related revenue, you have to debit your sales returns and allowances account by the amount of revenue generated by the original sale. Then, you have to credit your accounts receivable or cash account by the same figure. A seller will then have to record a sales return by debiting a Sales Return and Allowances account and crediting the Accounts Receivable account in a case where the sale is made on credit. The credit to the accounts receivable account will reduce the outstanding amount of accounts receivable.

How to Record a Sales Revenue Journal Entry

The journal entries for sales returns from XYZ Co. are as follows. Instead of debiting the sales returns account, companies will debit the sales allowances account. Like other contra accounts, the contra revenue account goes against revenues in the income statement.

Are the Accounts Receivable Current or Non-assets?

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency. Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price. So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited.

To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances. In a single-step income statement, we do not present the sales return and allowances separately. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts. Therefore, sales returns should not cause too much concern for companies.

- A company may choose any approach depending on its volume of returns and allowances transactions during the year.

- If no sales returns and allowances account is there, the revenue reversal entries will be different (as shown below).

- This sales return allowance account is the contra account to the sales revenue account.

- Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales.

- During this process, the goods may go under physical changes or deformities.

- To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances.

Similarly, it will include the terms and conditions for which the returns will be acceptable. Revenues define the income from a company’s operations during an accounting period. These revenues may arise from the sale of either goods or services. Regardless of their source, revenues play a significant role in a company’s profits and success. Therefore, companies strive to increase the numbers as high as possible.

All returned items and items subject to discounts/allowances must be reflected in the company’s income statement. These returns and allowances, in turn, reduce either credit sales, accounts receivable, or cash in the company’s balance sheet. In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues. In some cases, companies might not include sales returns and allowances as a separate account. Instead, they record sales returns and allowances by directly debiting their sales accounts before crediting their accounts receivable or cash account.

In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account. By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn. The accounts receivable account is debited to indicate that ABC Electronics has sold the desktop computers and is expecting to receive $6,000 from customers. The sales revenue account is credited to show the income earned from the sale, which increases the company’s equity.

This process begins with inputting the hours worked, any overtime, and relevant deductions into Xero’s payroll system. Payroll settings such as tax rates, employee benefits, and payment schedules must be accurately configured to ensure compliance with regulations and timely payments. As Xero calculates the pay, it also accounts for any leave taken and calculates the taxes owed.

But it’s worth the cost, because of the advantages it brings.

Employee self-service with cloud payroll

This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit to how many people can be part of the team. The Early subscription is tailored for solopreneurs and business owners who are just getting started. You’re able to send 20 quotes and invoices per month, enter five bills, reconcile bank transactions, capture bills and receipts with Hubdoc and view a short-term cash flow and business snapshot. For a small business owner, payroll is a system for paying the correct amounts of money to the right people on the required dates. There are lots of calculations to do, deadlines to meet, and forms to fill out. Encourage them to check that pay, benefits, and taxes are being reported correctly.

- Easy-to-use accounting software, designed for your small business.

- Start by working out what you owe each employee for the period, then make the required deductions.

- Simple sign-up process, where they walk you through each step.

- Compliance checks involve verifying adherence to labor laws, wage regulations, and employee benefits laws, ensuring that the payroll process meets legal standards and avoids penalties or fines.

Automate Your Payroll Process

Before starting work, your employees need to fill out a W-4 form and state tax form. The information they give on these forms helps you figure out how much tax to withhold from their pay. They’re also required to tell you any time there’s a change in their circumstances.

This process is crucial to maintain accuracy and compliance with government regulations. By reviewing each payroll transaction, discrepancies and errors can be identified and rectified, safeguarding the integrity of the payroll system. It provides an opportunity to ensure that all necessary tax withholdings and deductions are in line with statutory requirements. This is where the step-by-step Xero payroll guide becomes invaluable, providing a clear framework for gathering and entering essential employee information.

Choosing the right payroll software

Then again, QuickBooks requires user limits for each plan while Xero doesn’t. We compared the two options in terms of their key features, pricing and customer service to help you decide which is right for your business. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident integrating with adp workforce now 2021 in your accounting platform when it comes to keeping your information safe. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month). Xero, on the other hand, offers unlimited users for all plans.

Step 3: Set Up Payroll Settings

Many businesses set up a separate bank account for holding that money to avoid spending it. Xero does not provide accounting, tax, business or legal advice. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. Automate taxes, deductions and filings with Xero payroll software.

The business’s commercial services are cash flow and budgeting, tax preparations, financial statements, tax compliance, and payroll services. Personal services are tax assistance, tax compliance, and financial planning. Linda has over 30 years of experience as a CPA and she is a member of the American Institute of Certified Public Accountants and the Washington State Society of Certified Public Accountants. Linda M. Teachout, CPA, PLLC is accredited by the Better Business Bureau and has an A+ rating. Overall Office Solutions is a Kent business that has been serving small businesses for over seven years. The business offers bookkeeping services and packages are basic bookkeeping, mid-level bookkeeping, and advanced bookkeeping.

Professional bookkeeping & accounting with a personal touch.

Let’s chat about how we can help get your business accounting back on track and getting you back to doing what you do best. We have the experience and knowledge to tailor our processes to match your needs to provide you reliable results.

- George Dimov, CPA, offers bookkeeping services to commercial clients in Seattle.

- Once we have everything set up, we’ll complete a month of your bookkeeping.

- With Bench, you get a team of real, expert bookkeepers in addition to software.

- Florina has more than 15 years of tax and accounting experience and is a Certified QuickBooks ProAdvisor.

- Clients appreciate their efficiency, reliability, and professionalism.

- Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs.

Service Providers

This is where our team of experts can help you determine what taxes you need to pay and how much you owe. Cheryl’s personable attention and wide experience in the Seattle area in accounting will be a strong asset to your Seattle business. Her understanding of up-to-date tax laws and small business requirements will save you time and money. You are guaranteed to receive efficient, honest bookkeeping services that will ensure your satisfaction.

What is double entry bookkeeping?

Overall Office Solutions also offers stand-alone services which include notary services, payroll processing, reconciling, and QuickBooks set-up. Nancy Morelli has more than 20 years of accounting and administrative experience. Overall Office Solutions is accredited by the Better Business Bureau and has an A+ rating. Honest Buck Accounting is a Seattle business that has been serving clients for over eight years. The business’ services include bookkeeping, CPA services, and taxes.

We went through 5 different bookkeepers in the first four years of our business and then we found Vanessa. I have to say hiring Vanessa as a bookkeeper for our company was one of the best decisions of my life. It has been almost 10 years now and I https://www.bookstime.com/articles/financial-leverage sleep very well knowing that our books are under Vanessa’s control. She is always there for you, ready to answer any questions, always professional and very effective. With Bench, you get a team of real, expert bookkeepers in addition to software.

Bookkeeping services include income statement, general ledger maintenance, income statements, and checks and balances. Honest Buck Accounting offers an initial consultation and has three packages. Florina’s Accounting & Tax Services LLC is a Normandy Park business that serves individuals and businesses. Services include tax planning and consulting, business tax returns, individual tax returns, bookkeeping, payroll, QuickBooks set-up and training, and small business accounting. Florina has more than 15 years of tax and accounting experience and is a Certified QuickBooks ProAdvisor.

What does a bookkeeper do for a small business?

Please take a minute to provide your email to begin receiving our newsletter which also offers assistance with tax preparation, tax filing deadlines, and provides valuable free resources. Your bookkeeping team consists of 3 professionally trained bookkeepers, including one senior bookkeeper who reviews all of your monthly statements and your Year End Financial package. We’ll take bookkeeping off your plate so you can focus on the more important parts of the business while we handle the complexities and nuances of Washington State taxes. Vazquez & Co. is a Seattle CPA firm that has been serving small businesses for over 19 years.

Based in Washington, we are the premiere choice for high-quality bookkeeping done fast and accurately.

You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your seattle bookkeepers bookkeeping team, it’s as simple as uploading a file. Seattle based businesses are able to take advantage of Washington State’s no corporate tax and personal income tax laws. However, despite this tax advantage compared to most other states, businesses in Seattle may still be subject to taxes.

Is bookkeeping hard?

Your Balance Sheet, LLC is an Everett business that has been serving the Greater Puget Sound area for over 18 years. Your Balance Sheet, LLC is accredited by the Better Business Bureau and has an A+ rating. The business has won numerous awards including Best of Mukilteo in 2014 and 2015 that was presented by Best Businesses and Accounting Service in 2015 presented by the Seattle Award Program. Clients appreciate their efficiency, reliability, and professionalism. George Dimov, CPA, offers bookkeeping services to commercial clients in Seattle.

Content

- Limitations of Trade Discounts

- Is there any other context you can provide?

- Time Value of Money

- Business Mathematics

- Accounting for Trade Discount

The trade discount may be stated as a specific dollar reduction from the retail price, or it may be a percentage discount. Consequently by varying the level of trade discounts the business can change the price given trade discount to different customers. For example, a retail customer might be charged the full list price, whereas a customer who purchases products in large volumes might be given a large trade discount and a lower price.

Cash discounts are a percentage reduction in the invoice amount based on payment terms. The seller would not log the trade discount in its accounting records but only record revenue corresponding to the amount invoiced for the customer. Trade discounts can benefit suppliers by increasing sales volume, reducing inventory costs, and attracting and retaining customers. They can benefit customers by reducing overall costs, increasing profitability, and enhancing competitiveness. However, trade discounts have some limitations, and suppliers and customers should manage them carefully to ensure their effectiveness. While trade discounts can be beneficial to both suppliers and customers, there are some limitations to consider.

Limitations of Trade Discounts

Manufacturers and wholesalers typically produce catalogs for customers and vendors to order products from. The prices listed in the catalogs are often called list prices or manufacturers suggest retail price (MSRP). Other business within the industry that use the manufacturers products rarely pay list price for them. Instead, the manufacturer gives the wholesaler or retailer a discount on each purchase or a percent off of the list price. Purchasing in bulk offers resellers the opportunity to receive a trade discount from suppliers. The more goods purchased, the bigger the percentage of the price break; therefore, larger orders result in greater financial savings for those making wholesale purchases.

They’re generally part of marketing campaigns and can include tactics such as buy one get one free, or a percentage off for first-time buyers. If retailers are expected to pay $225 for a suit, a wholesaler has to pay less for it, because the wholesaler’s customers are retailers. Hence the wholesaler must get an additional discount to stay in business. This is usually given as a chained discount; which is a percentage of the price after the first (retailer’s) discount is taken. A reduction granted by a supplier of goods/services on list or catalogue price is called a trade discount. This is done due to business consideration such as trade practices, large quantity orders, etc.

Is there any other context you can provide?

It is important to note that the trade discount is applied to the list price, not the discounted price. For example, if the product already had a cash discount of 5%, the trade discount would still be calculated based on the list price, not the discounted price. As a result, customers can reduce their overall costs and increase their profitability by purchasing in bulk or at specific times. These are discounts offered to customers as part of a promotional campaign. For example, a supplier may offer a 20% discount on a new product for the first month of its release.

- They are offered in various forms, including quantity discounts, seasonal discounts, cash discounts, promotional discounts, and trade-in allowances.

- Carl&Co pays $6,600 for 50 desks after receiving a discount of $900.

- A manufacturer may attempt to establish its own distribution channel, such as a company website, so that it can avoid the trade discount and charge the full retail price directly to customers.

- Lastly, a registered high-volume wholesaler will be given a trade discount of 27% and will be charged $73.

- The amount of the trade discount varies depending on who is ordering the products and the quantities they are ordering.

- This type of discount helps to ensure profit for all parties involved in the transaction.

10 vehicles were purchased by Unreal Pvt Ltd with a 5% trade discount on the list price of 1,00,000 each. By following these practices, suppliers, and customers can maximize the benefits of trade discounts and improve their bottom line. Trade discounts are a powerful tool for increasing sales, reducing costs, and fostering long-term relationships between suppliers and customers. Another limitation of trade discounts is that they may create a sense of dependency on the supplier.

Time Value of Money

They have has been part of business transactions since the beginning of time. Buyers offer discounts and sellers receive it, either implicitly or explicitly. The purpose of this article is to explain the difference between trade discount and cash discount in detail. One limitation is that trade discounts may not always lead to increased sales.

This helps businesses maintain cash flow throughout the year and keep inventory fresh. This discount serves as a strategy to incentivize the buyer to make a purchase, particularly in large quantities, thereby fostering a symbiotic relationship between the two parties. In the realm of financial management, a trade discount is a critical tool https://www.bookstime.com/ for boosting sales volume and enhancing cash flow. By offering a trade discount, the manufacturer or wholesaler encourages the retailer to stock and promote their product, ensuring greater market visibility and product turnover. Trade Discount is the reduction in the retail price of products that arises from bulk sales or purchases.

Business Mathematics

A trade discount is a reduction in the selling price of goods provided to customers. This discount occurs before a company calculates the amount payable by the customer. Accounting standards do not require a separate treatment or disclosure on the financial statements for this discount.

The Master Admin for your Quickbooks Accountant flexible budgeting in an activity account must set up a Box account before you can request or receive documents. Access all your clients’ QuickBooks Online files under one login, from any device, by adding QuickBooks Online Accountant for your firm. Intuit Enterprise Suite is a cloud-based, multi-entity and multi-dimensional solution that helps boost productivity and profitability for clients with complex needs.

Advisory training

When you have questions or need assistance with a task in QuickBooks Accountant Online (or Quickbooks Online), click the Help menu. Click a client’s name in the dashboard to see lots of info about that client. Customizable reports show how business is doing, and where to improve. Find help articles, video tutorials, and connect with other businesses in our online community. Answer a few questions about what’s important to your business and we’ll recommend the right fit.

By accessing and using this page you agree to the Website Terms of Service. Get a bird’s-eye view of all your clients and projects, and work more efficiently so you never miss a deadline. Manage your firm’s books with the powerful features of QuickBooks Online Advanced. Automatically identify and resolve common bookkeeping issues so the books are closed accurately and on time.

When you sign up for QuickBooks Online Accountant, you’re automatically enrolled in the ProAdvisor Program. Access free training, business development resources and enhanced product support. Your clients will love the benefits of QuickBooks Online, including less data entry, secure file transfers and collaboration with you, right in their books.

From bookkeeping to strategic advising, accounting pros have the power to be a financial superhero for small businesses. If that sounds like you, QuickBooks Online Accountant has the tools, training, and community to support you every step of the way. From the client dashboard, you can see the client’s last paycheck date and the next payroll item due. With real-time data and reports, you and your clients can quickly see how much they’re earning, and where to invest their time.

Track a document request

Access your clients’ QuickBooks Online through QuickBooks Online Accountant to get seamless collaboration and essential work tools at your fingertips. Connect payroll, tax solutions, and 3rd-party apps to accelerate and enrich your work. Self-paced lessons help grow your knowledge and skills to advise your clients. correlation coefficient vs coefficient of willpower: what’s the distinction in easy terms Click Your Books in the navigation bar on the left side of the screen to manage your own firm’s books and payroll.

Access resources to help you identify the right clients and tools to help migrate them from desktop to the cloud. QuickBooks Online Accountant is designed to centralize all the tools you use to manage your business. No matter your clients’ needs, you’ll find solutions for now and down the road. Support your fastest-growing clients and accelerate your work with our most powerful cloud edition – Quickbooks Online Advanced. QuickBooks Online syncs all your clients’ data and apps in one place. Waste less time while helping them earn more at tax season.

- Customizable reports show how business is doing, and where to improve.

- Support your fastest-growing clients and accelerate your work with our most powerful cloud edition – Quickbooks Online Advanced.

- Intuit Enterprise Suite is a cloud-based, multi-entity and multi-dimensional solution that helps boost productivity and profitability for clients with complex needs.

- The Accountant Toolbox holds essential work tools, reports, and shortcuts inside your clients’ QuickBooks Online, so you can take actions without missing a beat.

Add a client

QuickBooks Online Accountant isn’t just a portal to your client’s books—it’s the one place to grow and manage your entire practice, at your pace. Get access to everything from discounts to marketing tools and exclusive training with Pro Advisor. Close your clients’ monthly books with increased accuracy and in less time with new month-end review. Grow your practice and empower your clients with tools made just for accountants. profitability ratios definition The Accountant Toolbox holds essential work tools, reports, and shortcuts inside your clients’ QuickBooks Online, so you can take actions without missing a beat. You’ll see your request, whether your client has uploaded the documents that you need, and when they uploaded each document.

To see all your shared and private documents in a list, click the Documents tab. When your client sends you back the document you requested, you’ll be notified in QuickBooks Accountant. Wholesale billing allows you and your clients to reduce expenses while you share a discount that never expires with your clients for QuickBooks Online with or without Payroll. This guide provides you with an overview of how to get started using the software including all the latest features. Learn how to work even more efficiently, so you can grow your firm and offer more detailed advice and attention to your clients. See all your clients in one location and click directly into their books.

However, if management wants to determine the profitability of a specific product or customer, it is necessary to allocate or assign nonmanufacturing costs to the products and/or customers outside of the financial statements. In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit. Job order costing requires the assignment of direct materials, direct labor, and overhead to each production unit. The primary focus on costs allows some leeway in recording amounts because the accountant assigns the costs. When jobs are billed on a cost-plus-fee basis, management may be tempted to overcharge the cost of the job. Cost-based contracts may include a guaranteed maximum, time and materials, or cost reimbursable contract.

- Effective management of nonmanufacturing costs is crucial for businesses aiming to optimize their financial performance and strategic decision-making.

- Moreover, variance analysis can be broken down into different types, such as price variance and volume variance.

- Tracking the exact amount of adhesive used would be difficult, time consuming, and expensive, so it makes more sense to classify this cost as an indirect material.

- In the end, management should know whether each product’s selling price is adequate to cover the product’s manufacturing costs, nonmanufacturing costs, and required profit.

- As direct materials, direct labor, and overhead are introduced into the production process, they become part of the work in process inventory value.

- These expenses stay the same regardless of the level of production, so per-item costs are reduced if the business makes more widgets.

- For example, the property tax on a factory building is part of manufacturing overhead.

How to calculate total manufacturing cost?

We use the term nonmanufacturing overhead costs or nonmanufacturing costs to mean the Selling, General & Administrative (SG&A) expenses and Interest Expense. Under generally accepted accounting principles (GAAP), these expenses are not product costs. (Product costs only include direct material, direct labor, nonmanufacturing costs include and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred. Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements.

Create a free account to unlock this Template

Manufacturing costs, for the most part, are sensitive to changes in production volume. As the rate of production increases, the company’s revenue increases while its fixed costs remain steady. Therefore, the per-item cost of manufacturing falls and the business becomes more profitable. Product costs are treated as inventory (an asset) on the balance sheet and do not appear on the income statement as costs of goods sold until the product is sold. Changing from the traditional allocation method to ABC costing is not as simple as having management dictate that employees follow the new system.

Production Costs vs. Manufacturing Costs Example

You are deciding whether to purchase a pizza franchise or open your own restaurant specializing in pizza. List the expenses necessary to sell pizza and identify them as a fixed cost or variable cost; as a manufacturing cost or sales and administrative costs; and as a direct materials, direct labor, or overhead. For each overhead item, state whether it is an indirect material expense, indirect labor expense, or other. A benefit of knowing the production costs for each job in a job order costing system is the ability to set appropriate sales prices based on all the production costs, including direct materials, direct labor, and overhead. The unique nature of the products manufactured in a job order costing system makes setting a price even more difficult.

But note that while production facility electricity costs are treated as overhead, the organization’s administrative facility electrical costs are not included as overhead costs. Instead, they are treated as period costs, as office rent or insurance would be. When Dinosaur Vinyl requests materials to complete Job MAC001, the materials are moved from raw materials inventory to work in process inventory. We will use the beginning inventory balances in the accounts that were provided earlier in the example. The requisition is recorded on the job cost sheet along with the cost of the materials transferred. The costs assigned to job MAC001 are $300 in vinyl, $100 in black ink, $60 in red ink, and $60 in gold ink.

Benefit #3: Assess the profitability of a product

- Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products.

- Read advice from restaurant owner John Gutekanst about the importance of understanding food costs and his approach to account for these in his pizzeria.

- Nonmanufacturing, also known as “period” costs, consists of selling and administrative expenses.

- Now, add the value of existing inventory to the cost of purchasing new inventory to calculate the cost of direct materials.

- Then, add up the cost of new inventory — this is the cost of raw materials you purchase to manufacture the product.

- In his experience, the most common challenges are a lack of accurate data and the complexity of costing methods.

- As a result, the steel manufacturing company was able to achieve a 10% reduction in manufacturing costs and save €1 million (approximately $1.7 million) annually.

On the other hand, a product with a low gross profit may actually be very profitable, if it uses only a minimal amount of administrative and selling expense. Traditional billboards with the design printed on vinyl include direct materials of vinyl and printing ink, plus the framing materials, which consist of wood and grommets. The typical billboard sign is 14 feet high by 48 feet wide, and Dinosaur Vinyl incurs a vinyl cost of $300 per billboard.

- Investors and stakeholders can then make more informed decisions based on a comprehensive understanding of the company’s financial health.

- Manufacturing cost calculation gives an accurate view of the costs allowing companies to eliminate irrelevant costs and optimize resource utilization to boost profitability.

- A manufacturing company initially purchased individual components from different vendors and assembled them in-house.

- It is important to understand that the allocation of costs may vary from company to company.

- Manufacturing overhead, however, consists of indirect factory-related costs and as such must be divided up and allocated to each unit produced.

- For instance, by streamlining administrative processes and reducing overhead, a company can free up cash that can be reinvested into core business activities or used to pay down debt.

What are material costs in manufacturing?

During the finishing stages, $120 in grommets and $60 in wood are requisitioned and put into work in process inventory. The costs are tracked from the materials requisition form to the work in process inventory and noted specifically as part of Job MAC001 on the preceding job order cost sheet. Returning to the example of Dinosaur Vinyl’s order for Macs & Cheese’s stadium sign, Figure 4.7 shows the materials requisition form for Job MAC001.

Direct Manufacturing Overhead Costs

The vinyl and ink were used first to print the billboard, and then the billboard went to the finishing department for the grommets and frame, which were moved to work in process after the vinyl and ink. The final T-account shows the total cost for the raw materials placed into work in process on April 2 (vinyl and ink) and on April 14 (grommets and wood). The journal entries to reflect the flow of costs from raw materials to work in process to finished goods are provided in the section describing how to Prepare Journal Entries for a Job Order Cost System.

How to Calculate the Cost of Sales

The training company may charge for the hours worked by instructors in preparation and delivery of the course, plus a fee for the course materials. The manufacturing overhead is an expense of production, even though the company is unable to trace the costs directly to each specific job. For example, the electricity https://www.bookstime.com/ needed to run production equipment typically is not easily traced to a particular product or job, yet it is still a cost of production. As a cost of production, the electricity—one type of manufacturing overhead—becomes a cost of the product and part of inventory costs until the product or job is sold.

One advantage of the ABC system is that it provides more accurate information on the costs to manufacture products, but it does not show up on the financial statements. Explain how this costing information has value if it does not appear on the financial statements. It encompasses the costs that must be incurred so as to produce marketable inventory.

You can hand over your accounts payable and receivable to the company’s professional team. Besides paying your vendors on time, the firm will help you handle invoicing and call collection. If you use QuickBooks, then the firm can help you clean up and update your files.

Accounting services for small business should consider factors such as expertise, scalability, and technological capabilities. Reading client testimonials and reviews can provide valuable insights into the experiences of other businesses, helping in making an informed decision. You will work closely with dedicated accountants who will provide insight into your business’s financial health. Furthermore, Roberts Accounting serves the Los Angeles area with various tax solutions, from audit representation to tax planning. Alongside being reliable and accurate, Roberts Accounting services are equally cost-effective.

Alan Mehdiani, CPA, Tax Accountant

By organizing and categorizing financial data, we provide a solid foundation for tax preparation. Our expertise allows us to identify eligible deductions, exemptions, and credits, maximizing tax savings while minimizing the risk of errors or audits. With a myriad of bookkeeping services in Los Angeles, choosing the right partner can be a pivotal decision.

Then, the company will prepare and send you a draft of your tax filing before the one-hour meeting. Rigits will provide insight into your financial status monthly, quarterly, and yearly. Of course, you can always reach out to the company if you require additional services. Plus, Rigits has impressive customer service and typically replies to any call or email within a short time.

Accounting Bookkeeper

The Carters often campaigned separately to get his name out before the public, and Rosalynn frequently put in 18-hour days. When he beat President Ford in the general election, she was given major credit for the victory. They grew together as full partners, and when he successfully ran for the state Senate in 1962, she helped him campaign — and kept the business running back home. Widely considered one of the most activist first ladies since Eleanor Roosevelt, Rosalynn Carter arrived in the White House with her own platform — mental health reform.

- Plus, Rigits has impressive customer service and typically replies to any call or email within a short time.

- By having accurate and timely financial information at your disposal, you can make informed decisions, identify growth opportunities, and address any financial challenges proactively.

- All your monthly bookkeeping tasks are handled for a low fixed monthly rate with no long-term contracts.

- Furthermore, the firm has a qualified team of QuickBooks Certified ProAdvisors who can help you find your way around the software.

Depending on the business entity you’re operating, we can also help you figure out which California state taxes you need to pay. When you choose us, you can expect confidentiality, reliability, and a commitment to excellence. Our team operates with the highest level of integrity and professionalism, providing you with reliable and accurate financial data that you can trust. We utilize the latest accounting software and tools to streamline your financial processes, ensuring accuracy, efficiency, and timely financial reporting.

Expert Bookkeepers in Los Angeles – Your Key to Financial Success

We offer affordable bookkeeping services so you can keep your business running smoothly without breaking the bank. Depending on the number of transactions, your business size, and the complexity of the work outsourced, a bookkeeper in LA can charge a monthly fee ranging from $200 to $2,500 per month. If you are on a low budget, many of these firms can customize the service to a rate you can afford. As a result, you can enjoy quality service as you would with a CPA while saving overhead expenses.

You can increase or decrease the volume of work without the constraints of managing an in-house team. It enables you to maintain efficient financial operations, regardless of fluctuations in your small business bookkeeping activities. We work closely with you to understand your business goals and tailor our services accordingly. Our proactive approach los angeles bookkeepers ensures that we anticipate your needs and provide solutions to optimize your financial operations. With Our Los Angeles Bookkeeping Services, you can free up your time, reduce the risk of errors, and gain valuable financial insights. We are dedicated to providing reliable, confidential, and efficient bookkeeping services to help your business thrive.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Get up and running with free payroll setup, and enjoy free expert support. Advanced analytics leverages techniques to provide insights about the past, present and future. We explore why accounting teams are so well-suited for automation solutions.

Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results. Monitor and analyze user performance, ensuring key actions quickly. Perform pre-consolidation, group-level analysis in real-time with efficient, end-to-end transparency How to start a bookkeeping business in 9 steps and traceability. Reduce risk and save time by automating workflows to provide more timely insights. Streamline and automate detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching all in one centralized workspace.

Alert: highest cash back card we’ve seen now has 0% intro APR until nearly 2025

The entry is mapped to the respective accounts, which are debited and credited accordingly. Want to learn more about recording financial transactions and doing accounting for your small business? Now, it would be ridiculous to make an adjusting entry every time an employee sits on their office chair or uses the paper shredder.

- While preparing the trading account, we need to deduct the amount of income received in advance from that particular income.

- Create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service.

- The entry is being simultaneously added with another entry (the payment account) that reduces the cash balance of a business unit.

- Prepaid expenses are considered current assets because they are expected to be utilized for standard business operations within a year.

While the responsibility to maintain compliance stretches across the organization, F&A has a critical role in ensuring compliance with financial rules and regulations. Together with expanding roles, new expectations from stakeholders, and evolving regulatory requirements, these demands can place unsustainable strain on finance and accounting functions. Retailers are recalibrating their strategies and investing in innovative business models to drive transformation quickly, profitably, and at scale.

Question: Are prepaid expenses recorded in the income statement?

In this context, we are going to discuss , Accrued Income, and Income Received in Advance from an organization’s point of view.

Although being a simple concept, it is important for an organization to correctly account for and recognize prepaid expenses on its balance sheet. Prepaid assets typically fall in the current asset bucket and therefore impact key financial ratios. Additionally, an organization reporting under US GAAP must follow the matching principle by recognizing expenses in the period in which they are incurred. This requires proper calculation and amortization of prepaid expenditures such as insurance, software subscriptions, and leases. After each accounting period, the journal entry is posted that reflects the portion of the expense incurred for that specific period according to the established amortization schedule. The journal entry credits the prepaid asset account (on the balance sheet) and debits the expense account (on the income statement).

Accounting and Automation Benefits, Tips & Guide

As a result of not being a cash equivalent or highly liquid, https://adprun.net/how-to-do-accounting-for-your-startup/ do not impact the quick ratio. Under the accrual method of accounting, income is recognized when it is earned and expenses are recognized when incurred, regardless of when cash exchanges hands for the transaction. Prepaid expenses are an asset because the business has not realized the value of the good or service when cash initially exchanges hands. Prepaid expenses are payments made in advance for products or services to be used in the future. Prepaid expenses are recognized as an asset because they provide future economic benefits to a company. A prepaid expense journal entry serves as a recording in the accounting books to acknowledge an expense that has been paid ahead of time.

- The software that’s sold with this type of arrangement is often referred to as SaaS, or “Software as a Service,” because of its similarity to service contracts.

- Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

- This ensures accurate financial reporting and prevents any discrepancies in the company’s records.

- Without accurate information, organizations risk making poor business decisions, paying too much, issuing inaccurate financial statements, and other errors.

- They are initially treated like assets their value is expensed over time onto the income statement.

- The outstanding expense is a personal account and is treated as a liability for the business.

Advanced algorithms continuously monitor and analyze transaction data, detecting patterns and anomalies that might signal fraudulent activity. By harnessing the power of AI, these companies can quickly identify and mitigate potential threats, ensuring that customer payments remain secure. Planful is a comprehensive financial performance platform aimed at driving financial success across businesses.

AccountsIQ

Looking at the financial-services industry specifically, we have observed that financial institutions using a centrally led gen AI operating model are reaping the biggest rewards. As the technology matures, the pendulum will likely swing toward a more federated approach, but so far, centralization has brought the best results. Deep networks, in particular, efficiently predict the direction of change in forex rates thanks to their ability to “learn” abstract features (i.e. moving averages) through hidden layers. Future work should study whether these abstract features can be inferred from the model and used as valid input data to simplify the deep network structure (Galeshchuk and Mukherjee 2017).

Solve your business challenges with Google Cloud

Traders with access to Kensho’s AI-powered database in the days following Brexit used the information to quickly predict an extended drop in the British pound, Forbes reported. It allows users to directly import from or export to various platforms, ensuring a smooth transition without disrupting existing systems. Nanonets provides solutions for an array of financial tasks, including bill pay, AP automation, invoice processing, expense management, accounting automation, and tax refund calculator accounts receivable, among others. To capture the benefits of these exciting new technologies while controlling the risks, companies must invest in their software development and data science capabilities. And they will need to build robust frameworks to manage data quality and model engineering, human–machine interaction, and ethics.

Enhance risk management

The audit feature lets you perform your audit in a fraction of the time by having all data sources in one place and being able to compare transactions or supporting documents anytime, anywhere. Trullion redefines financial processes with its AI-powered platform designed to automate manual work for finance and audit teams. With a focus on ensuring accuracy, compliance, and confidence, Trullion transforms accounting practices for businesses. Truewind also distinguishes itself through its AI-powered bookkeeping and finance features. These include direct bank account integration, automated transaction tagging, and the processing of uploaded invoices and contracts.

- Financial institutions that successfully use gen AI have made a concerted push to come up with a fitting, tailored operating model that accounts for the new technology’s nuances and risks, rather than trying to incorporate gen AI into an existing operating model.

- The company says creating an account is quick and easy for buyers who can get approved to start accessing flexible payment terms for hardware and software purchases by the next day.

- This article does not contain any studies with human participants performed by any of the authors.

- The platform offers unparalleled accuracy in bookkeeping and the creation of detailed financial models.

- In this section, we further scrutinise, through content analysis, the papers published between 2015 and 2021 (as we want to focus on the most recent research directions) in order to define a potential research agenda.

Kensho Technologies

They cost benefit analysis also believe that the activity of financial influencers, such as financial analysts or investment advisors, potentially affects market returns and needs to be considered in financial forecasts or portfolio management. Bank default prediction models often rely solely on accounting information from banks’ financial statements. To enhance default forecast, future work should consider market data as well (Le and Viviani 2018). Fraud detection based on AI needs further experiments in terms of training speed and classification accuracy (Kumar et al. 2019).

Kathleen is CPMAI+E capital and maintenance certified, and is a lead instructor on CPMAI courses and training. Follow Walch for coverage of AI, ML, and big data use cases, applications, and best practices. Gradient AI specializes in AI-powered underwriting and claims management solutions for the insurance industry. For example, the company’s products for commercial auto claims are able to predict how likely a bodily injury claim is to cross a certain cost threshold and how likely it is to lead to costly litigation.

Artificial intelligence (AI) in finance is the use of technology, including advanced algorithms and machine learning (ML), to analyze data, automate tasks and improve decision-making in the financial services industry. With Oracle Fusion Cloud ERP, companies have a centralized data repository, giving AI models an accurate, up-to-date, and complete foundation of data. With a complete, cloud ERP system that has AI capabilities built-in, finance teams can get the data they need to help increase forecasting accuracy, shorten reporting cycles, simplify decision-making, and better manage risk and compliance. With Oracle’s extensive portfolio of AI capabilities embedded into Oracle Cloud ERP, finance teams can move from reactive to strategic with more automation opportunities, better insights, and continuous cash forecasting capabilities. The volatility index (VIX) from Chicago Board Options Exchange (CBOE) is a measure of market sentiment and expectations.

Content

- Actual Cost Adjustments

- Defining Expenses to Allocate

- How Does Period Cost Work

- Period Cost vs. Product Cost

- Inventory Transfer of Products

As an extension to the Zero Activity Cost Adjustments feature, any Adjustments are also selected even if the quantity is zero. The only limitation is that the cost specified with a zero quantity is applied to the entire Item Transaction Quantity for the period concerned and not to a per unit cost. This is displayed as a message whenever you specify zero in the Adjustment Quantity field on the Actual Cost Adjustments window. To include operation and routing costs in your product costs, routes must be assigned to the product. To do this, you need to set up operations, include the operations in routings, create a formula effectivity record for the product, and include the routing in the formula effectivity record.

- Refer to Oracle Process Manufacturing Product Development User’s Guide for details on the Fixed by Charge scaling type.

- This relationship is maintained in the case of process to discrete transfer.

- When the product is sold, the costs move from the finished goods inventory into the cost of goods sold.

- You may need to physically count everything in inventory or keep a running count during the year.

- To use the inventory cost method, you will need to find the value of your inventory.

Period costs are also listed as an expense in the accounting period in which they occur. Unlike period costs, product costs are tied to the production of a product. Some examples of what a product costs include, direct labor, raw materials, manufacturing supplies, and overhead that is directly tied to the production facility, such as electricity.

Actual Cost Adjustments

Professional service fees, such as your lawyer and CPA fees, are administrative expenses. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Of course the yeast and flour will also be a direct cost of the Mixing Department, but it is already

a direct cost of each kind of bread produced. Whenever there is a non-zero expense amount that could not be allocated because the total quantity is zero, a warning is displayed. Ensure that expenses are allocated in the correct period and that batches are completed and closed in the same period.

This means that a company need not wait until the end of accounting periods to find out these crucial financial metrics. It also means that approximate calculations are replaced by real, data-based numbers, increasing the accuracy of financial statements. The other half of the COGM formula accounts for the work in process or WIP Inventory.

Defining Expenses to Allocate

For each resource, the component class, analysis code, and the component cost from the resource is listed. For actual cost types, routing details from the closed batches used by the actual cost process are displayed here. The resources are those defined in the routing operations for the routings used in each batch from which actual costs are calculated.

Is R&D a period cost?

Research and development or R&D costs are directly tied to the COGS of specific products and treated as overhead costs. Charging this overhead cost to the COGS of the recent period and considered as period cost. Thus, all the research and development or R&D costs are treated as period costs.

When the transaction is received in PR1, a second row is created in the transaction table for the target organization (PR1). The transaction is owned by PR1 but an accounting entry is generated for M3 to clear the intransit entry and record an Interorg Receivables entry. The journal entry for M3 is created only when the receipt is completed. For example, at Cincy Chips the manufacturing line can produce up to 1,000 units per day.

How Does Period Cost Work

The existing OPM Actual Costing process only considers the Receipt, Invoice, Production or Consumption of items as transactions or Activities applicable for that item. You can alter the cost after it is calculated based on transaction records using the Expense Allocations and Cost Adjustments functionality. When you enter item code and tab out of the field, the cost component class, analysis code, and inventory organization fields default from the previous record. To evaluate the cost of an item, the Actual Cost process looks at transfer records, which are either completed or canceled in the current period. The Actual Cost process considers both activity factors and charges as they are included in the batch transaction details when calculating costs.

Customer research may be the most important step in building and maintaining any product. Many product managers and stakeholders bookkeeping for startups think they know what the customer wants. Sometimes they’re right, but when they’re wrong, the consequences could be disastrous.

“Period costs” or “period expenses” are costs charged to the expense account and are not linked to production or inventory. Cost of goods sold refers to the cost of production of goods, so it is a period cost. Following accounting standards, the cost of inventory, or cost of goods sold, is any cost incurred to get inventory ready to be sold.