Content

C) Is the process of allocating to expense the cost of a plant asset. Sum-of-years digits is a depreciation method that results in a more accelerated write off of the asset than straight line but less than declining-balance method.

Siemens AG is a technology company with core activities in the field of automation, electrification, and digitalization. The company is a leading supplier of power transmission, power generation, and infrastructure solutions, coupled with automation, drive, and software solutions. Siemens operates in 9 business segments, namely, Siemens Healthineers; Digital Factory; Power and Gas; Energy Management; Siemens Gamesa Renewable Energy; Process Industries and Drives; Mobility; Building Technologies; and Financial Services . The companys Process Industries and Drives division offers PAM solutions such as process control solutions and plant engineering software. Depreciation expense spreads the cost of major equipment and assets over a period of time that spans a number of years. Estimates of average age and remaining useful life of a company’s assets reflect the relationship between assets accounted for on a historical cost basis and depreciation amounts.

Land

Alterations – A change in the internal arrangement or other physical characteristics of an existing asset so that it may be effectively used for a newly designated purpose. This estimate is updated until the project is out to bid. Permitted Assets means any and all properties or assets that are used or useful in a Permitted Business . Productive Assets means assets of a kind used or useful in the Cable Related Business.

This classification is rarely used, having been superseded by such other asset classifications as Buildings and Equipment. Rockwell Automation, Inc. is one of the worlds largest companies providing industrial automation power, control, and information solutions. The company operates in 2 major business segments, namely, Architecture & Software and Control Products & Solutions.

Plant Fund Definition

The original cost of this equipment may be capitalized and not depreciated. Any replacements to this base stock would be reported as operating expenses. The amount of the base stock would be adjusted only if there were a significant change in the size of the base stock. Accounts receivable is the money a business is owed for the goods and services it has rendered on credit.

What is net property plant and equipment?

Net PP&E is short for Net Property Plant and Equipment. Property Plant and Equipment is the value of all buildings, land, furniture, and other physical capital that a business has purchased to run its business. The term “Net” means that it is “Net” of accumulated depreciation expenses.

To calculate depreciation expense, use double the straight-line rate. For example, suppose a business has an asset with a cost of 1,000, 100 salvage value, and 5 years useful life.

Plant Asset Management Market Pam By Offering Software And Services, Deployment Mode Cloud

Improvement for one business is sure to look vastly different from that of another business. Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications.

Plant assets are a subset of the entire group of assets. They fall under the classification of long-term tangible assets. Plant assets, also known as fixed assets, must meet plant assets certain characteristics to qualify as plant assets on the balance sheet. They must have a relatively long life and the company must hold them for use rather than resale.

Significance Of Property, Plant, And Equipment Pp&e

Examine the seven steps in the planning process and discover how companies create different strategic plans to meet their goals. Learn the definition of sample space in statistics and understand more about sample space using sample space examples. Capitalize only site work in substantially new areas unless the work is part of a new building. Preservation/Restoration – Maintaining special assets in, or returning them to a level of quality as close to the original as possible.

IFRS permit the use of either the cost model or the revaluation model for the valuation and reporting of long-lived assets, but the revaluation model is not allowed under US GAAP. These monies shall be spent under the direction of the University System Board of Trustees in accordance with BOT Policy VI.A.2.1. See the Capitalization Grid for examples of capital and noncapital purchases and PPE Account Cheat Sheet for related account to use. Please notify USNH Accounting Services when this occurs so that the related asset inventory records can be adjusted accordingly.

Which of the following are assets?

Examples of assets that are likely to be listed on a company’s balance sheet include: cash, temporary investments, accounts receivable, inventory, prepaid expenses, long-term investments, land, buildings, machines, equipment, furniture, fixtures, vehicles, goodwill, and more.

In addition, ABB significantly invests in R&D to thrive in a competitive environment. In FY 2018, its R&D expenditure was USD 1.2 billion, that is, 4.1% of its total revenue. Further, the company is capitalized on partnerships with other professional third-party solution providers to ensure mutual profit and growth. Plant assets are stated at actual or estimated cost at date of acquisition. Construction is capitalized as expended and reflected in net investment in plant.

Plant assets usually generate value for the company over a duration of more than one year. This is why they are recorded in the books of accounts as long-term assets, specifically in a company’s balance sheet. Once a piece of equipment is acquired, it is not immediately registered as an expense.

How Are Plant Assets Recorded In Accounting?

Generated by expenses involved in the earning of the accounting period’s revenues. PAM solutions are used in the aerospace & defense industry to achieve multiple objectives. In the aerospace & defense industry, it is highly critical to optimize asset utilization and minimize the maintenance cost. PAM solutions are used in the aerospace & defense industry to monitor component supply, improve product quality, reduce production cycle, and optimize manufacturing processes. Emerson Electric Co. manufactures and develops process controls, systems, valves, and analytical instruments. The company offers industrial, commercial, automation, and residential solutions worldwide.

Purchases of PP&E are a signal that management has faith in the long-term outlook and profitability of its company. PP&E are a company’s physical assets that are expected to generate economic benefits and contribute to revenue for many years. Industries or businesses that require a large number of fixed assets like PP&E are described as capital intensive.

Types Of Plant Assets

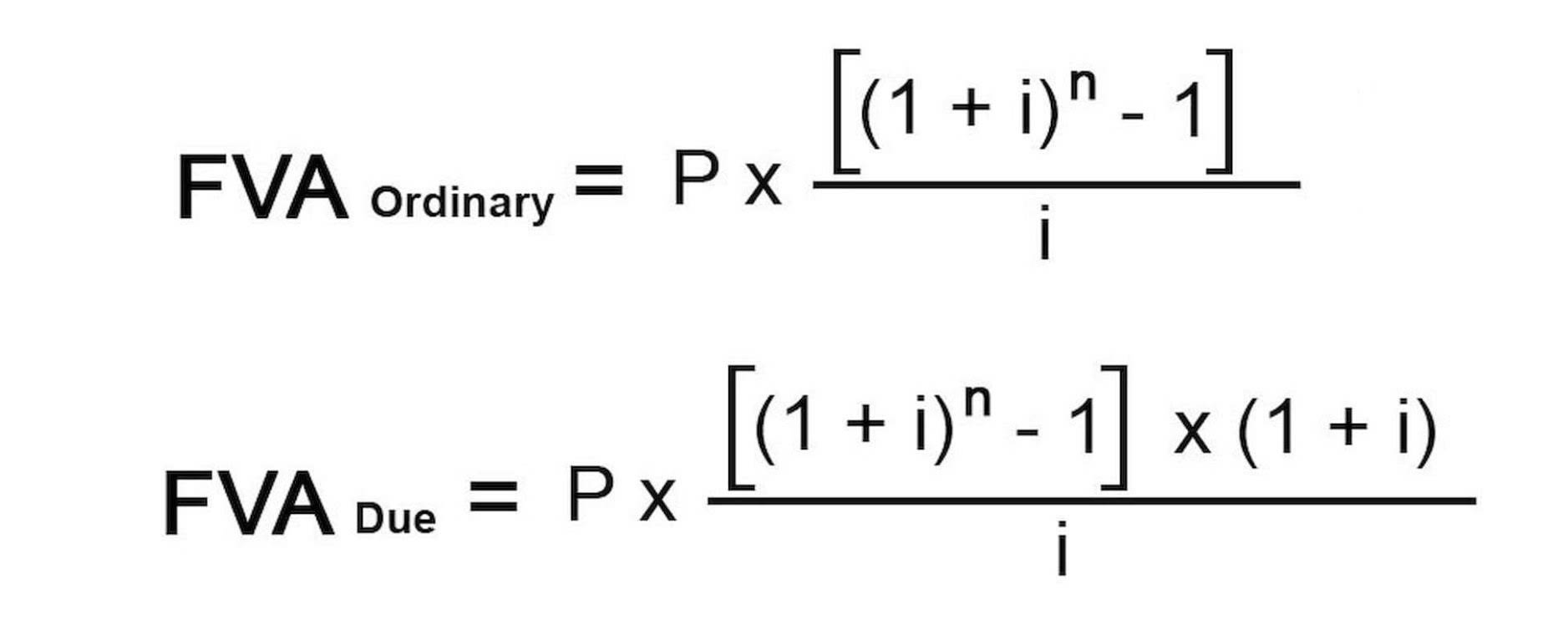

Some of the most common methods used to calculate depreciation are straight-line, units-of-production, sum-of-years digits, and double-declining balance, an accelerated depreciation method. The Modified Accelerated Cost Recovery System is the current tax depreciation system used in the United States. The PAM market in APAC is expected to grow at the highest CAGR during the forecast period. The adoption of PAM solutions is high in APAC due to the growing manufacturing sector in the region. Most of the key manufacturers from different industries have shifted their manufacturing plants in APAC due to the low labor cost and availability of a skilled workforce. These manufacturing units are using asset management solutions for the improvement in the overall manufacturing processes, which is expected to drive the growth of the PAM market in the region. In the oil & gas industry, PAM solutions are used to track material asset movements.

- The following customization options are available for the report.

- Calculate the dining room\’s forecasted numbers of meal sales for each period.

- ABB Ltd., a global leader in power and automation technologies.

- Losses and/or gains on the disposition of assets traded in on other assets are not recognized nor is accumulated depreciation figured on assets traded in when determining the cost of a new asset acquired.

- Construction is capitalized as expended and reflected in net investment in plant.

- DateAccountDebitCreditSep-15Accumulated Depreciation$5,600 Equipment$7,000To record disposal of equipmentNotice the exact opposite of the account balances is entered for each account.

PP&E are assets that are expected to generate economic benefits and contribute to revenue for many years. Noncurrent assets like PP& E are the opposite of current assets.Current assetsare short-term, meaning they are items that are likely to be converted into cash within one year, such as inventory.

Under this method, annual depreciation is determined by multiplying the depreciable cost by a series of fractions based on the sum of the asset’s useful life digits. The sum of the digits can be determined by using the formula (n2+n)/2, where n is equal to the useful life of the asset. All purchased property should be capitalized at purchase price plus acquisition costs. If existing buildings on the property will be utilized, the fair market value should be capitalized as buildings and the amount recorded as land would then be the difference between the total cost less the amount capitalized as buildings.

A fixed asset is a long-term tangible asset that a firm owns and uses to produce income and is not expected to be used or sold within a year. To determine net PP&E, add gross PP&E to capital expenditures. Once the useful life of the plant asset runs out, the asset is usually replaced and often sold at salvage value. This refers to the amount of money that a company hopes to earn after selling an asset that has already served its useful life. In double depreciation, a specific depreciation rate is allocated against the current value of the machine.

- Some factors to be considered in determining useful life include normal wear and tear, obsolescence due to normal economic and technological advances, climatic or local conditions and the hospital’s policy for repair and replacement.

- Learn more about its definition, characteristics, ingroups, and examples.

- WIP tracks capitalizable projects costs before projects are completed and ready for use.

- This more erratic pattern of ramping is altering—and in some cases ending—the long-standing, tidy definitions of intermediate and peaking missions for aging power plants.

- Sum-of-years’ digits is a depreciation method that results in a more accelerated write-off than straight line, but less accelerated than that of the double-declining balance method.

- Some projects may have an open punch list at this point.

Depreciation expense can be calculated using a variety of methods. The depreciation method chosen should be appropriate to the asset type, its expected business use, its estimated useful life, and the asset’s residual value. The expense is recognized and reported when the asset is placed into use and is calculated for each accounting period and reported under Accumulated Depreciation on the balance sheet and Depreciation Expense on the income statement. The amount reduces both the asset’s value and the accounting period’s income. A depreciation method commonly used to calculate depreciation expense is the straight line method. Frequently hospitals borrow funds to construct new facilities or modernize and expand existing facilities.

Netflix And Our Barbell Retirement Model – Seeking Alpha

Netflix And Our Barbell Retirement Model.

Posted: Fri, 10 Dec 2021 06:03:00 GMT [source]

The plant asset management market in APAC is expected to grow at the highest CAGR. Increasing demand for consumer electronic devices encourages growth of the semiconductor & electronics manufacturing industry across the world. The industry is highly competitive and forces manufacturers to reduce the operational cost.

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Other companies involved in the development of the PAM market are AB SKF , Endress+Hauser Management AG , General Electric Co. , Rockwell Automation, Inc. , Schneider Electric SA , Yokogawa , and Siemens AG . 80% of fortune 2000 companies rely on our research to identify new revenue sources. Under US GAAP, investment properties are generally measured using the cost model.