Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Upon receiving the machine and realizing how outrageously impractical their impulse i filed an irs return with the wrong social security number buy was, they sent it back. Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Return of Merchandise Sold on Account

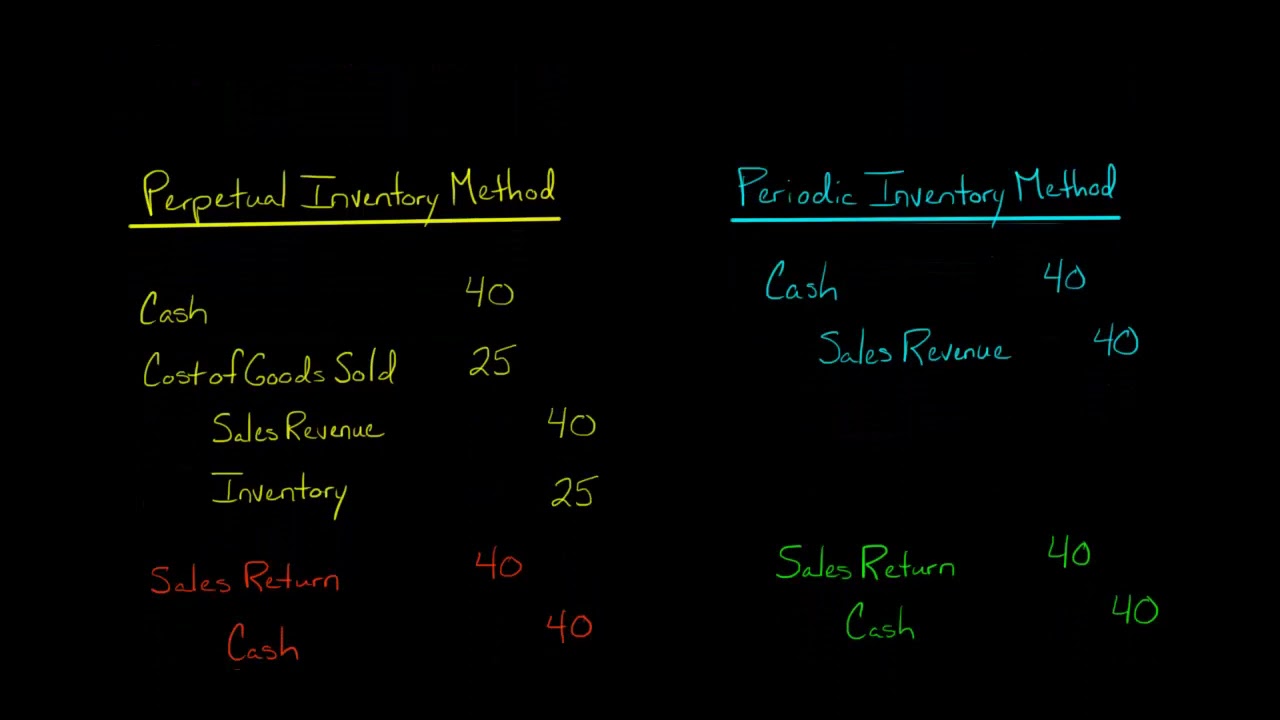

Sales returns and allowances is a contra revenue account with a normal debit balance used to record returns from and allowances to customers. The account, therefore, has a debit balance that is opposite the credit balance of the sales account. To reverse the return’s related revenue, you have to debit your sales returns and allowances account by the amount of revenue generated by the original sale. Then, you have to credit your accounts receivable or cash account by the same figure. A seller will then have to record a sales return by debiting a Sales Return and Allowances account and crediting the Accounts Receivable account in a case where the sale is made on credit. The credit to the accounts receivable account will reduce the outstanding amount of accounts receivable.

How to Record a Sales Revenue Journal Entry

The journal entries for sales returns from XYZ Co. are as follows. Instead of debiting the sales returns account, companies will debit the sales allowances account. Like other contra accounts, the contra revenue account goes against revenues in the income statement.

Are the Accounts Receivable Current or Non-assets?

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency. Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price. So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited.

To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances. In a single-step income statement, we do not present the sales return and allowances separately. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts. Therefore, sales returns should not cause too much concern for companies.

- A company may choose any approach depending on its volume of returns and allowances transactions during the year.

- If no sales returns and allowances account is there, the revenue reversal entries will be different (as shown below).

- This sales return allowance account is the contra account to the sales revenue account.

- Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales.

- During this process, the goods may go under physical changes or deformities.

- To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances.

Similarly, it will include the terms and conditions for which the returns will be acceptable. Revenues define the income from a company’s operations during an accounting period. These revenues may arise from the sale of either goods or services. Regardless of their source, revenues play a significant role in a company’s profits and success. Therefore, companies strive to increase the numbers as high as possible.

All returned items and items subject to discounts/allowances must be reflected in the company’s income statement. These returns and allowances, in turn, reduce either credit sales, accounts receivable, or cash in the company’s balance sheet. In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues. In some cases, companies might not include sales returns and allowances as a separate account. Instead, they record sales returns and allowances by directly debiting their sales accounts before crediting their accounts receivable or cash account.

In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account. By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn. The accounts receivable account is debited to indicate that ABC Electronics has sold the desktop computers and is expecting to receive $6,000 from customers. The sales revenue account is credited to show the income earned from the sale, which increases the company’s equity.