STP brokers have a bigger pool of partners compared to ECN, which means that some of the STP transactions might end up with DD brokers. ECN brokers supply many advantages, but their enterprise mannequin isn’t with out downsides. This article will look into the peculiar details of ECN brokers — explain their business model, and replicate on the strengths and weaknesses of this buying and selling community.

Matching methods receive orders and route the activity by way of a matching engine occasion where the costs are checked in opposition to current resting restrict orders. If no match is discovered, the order is placed in the book immediately as a quote. Call markets settle for orders one by one, with buying and promoting costs determined primarily based on the trade activity after the order is positioned.

Understanding The Stp Brokers

However, the ECN dealer will profit from commission charges per transaction – this is a fixed, clear commission. Using an ECN broker has a number of advantages; actually, a lot of merchants are looking forward to ECN brokers, and for a viable purpose. ECN brokers supply a spread of major advantages, which can assist them get ahead of their main counterparts. Additionally, ECNs often charge lower charges than market makers, which can save investors a significant amount of cash in the long term. Research exhibits that ECNs provide larger transparency and lower prices in comparability with market makers. Despite these challenges, the successful implementation of ECN buying and selling methods has been seen in numerous monetary markets worldwide.

By buying and selling by way of an ECN, a foreign money trader usually advantages from larger value transparency, sooner processing, elevated liquidity and more availability in the marketplace. Banks additionally cut back their prices as there may be less handbook effort involved in using an ECN for trading. In my humble opinion, ECN made a revolution within the international exchange buying and selling. Previously, a trader couldn’t have imagined that the role of brokers and other members would be completely eradicated, opening up the risk of truthful and clear buying and selling. ECN account is an easy and handy way to get the very best stage of companies offering entry to the interbank market. Narrowest spreads and clear commissions make ECN accounts a perfect technique of successfully applying various trading methods.

ECN buying and selling is an extremely environment friendly course of utilizing refined technology. Linking all traders, giant and small, instantly with liquidity suppliers eliminates the need for a ‘middleman’ in your transactions. Through ECNs, merchants get better costs and cheaper trading situations as an ECN broker is able to enable prices from completely different liquidity suppliers. Plus, the buying and selling environment supplied by an ECN broker is extra environment friendly and clear, adding further to the attraction of e-trading. With its many advantages together with low charges, fast execution times, and higher transparency than traditional exchanges, it could be just what you have to take your trading to the subsequent degree. Case studies have highlighted particular advantages such as faster execution occasions and entry to a wider range of liquidity providers.

Ecn Trading: Unleashing The Power Of Electronic Communication Networks! (updated

For example, while STP brokers may provide lower costs, their lackluster liquidity pools may offset the negative impression of decreased trading commissions. Thus, the right strategy is to weigh the positives and negatives of every providing and think about if the corresponding liquidity swimming pools are deep sufficient for specific buying and selling needs. While the ECN mannequin holds numerous benefits over STP, it also comes with a significantly large price tag. Most ECN brokers charge substantial commissions for his or her companies, accumulating large whole charges in case of high-volume transactions.

- Pro ECN is positioned as an account that completely eliminates the spread, which is why the commission charged right here is greater.

- Support for complex multi-attribute negotiations is a important success factor for the next technology of electronic markets and, extra typically, for every type of electronic exchanges.

- Price quotations are gathered from numerous market individuals, meaning ECN trading avoids wider spreads.

- In STP mode, the commission is commonly part of the spread whereas in ECN it is charged individually.

- These platforms enable market individuals to match buy and sell orders instantly with one another without intermediaries such as brokers or sellers.

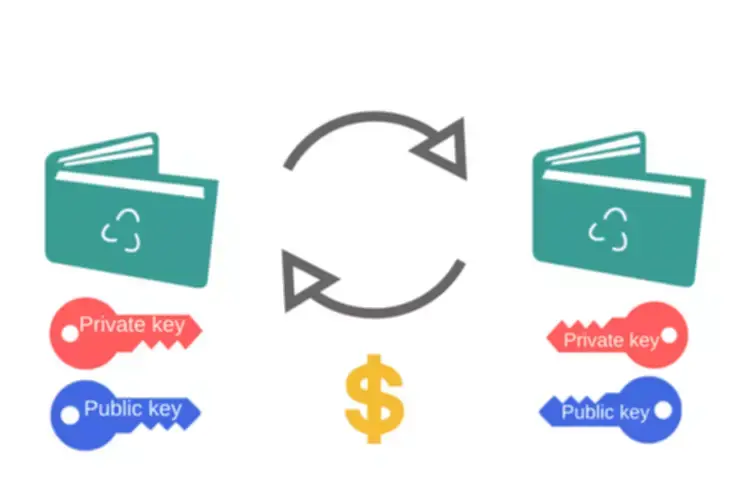

This is in distinction to traditional exchanges like NASDAQ and NYSE Arca, where market makers facilitate trades during market hours. These platforms enable market members to match buy and sell orders immediately with one another with out intermediaries corresponding to brokers or dealers. ECN buying and selling methods are totally different from conventional market makers as a end result of they don’t act as counterparties to trades. By utilizing an ECN for foreign foreign what is ecn broker money trading, you’ll have the ability to entry a bigger pool of liquidity suppliers, which might enhance trade execution quality. ECNs facilitate trading by allowing buyers and sellers to execute trades directly without the need for a market maker. Unlike traditional brokers who might charge hidden charges or markup spreads, ECN brokers usually cost a small fee on trades and supply tighter spreads.

Thus, I decided to dedicate a whole part to it, which you’ll read under. ECNs, or digital communication networks, are computerized networks in which merchants can trade instantly with each other. ECNs have a number of benefits, including tighter spreads and extra choices for after-hours trading. ECNs have difficult inventory exchanges through their interaction with NASDAQ.

Examples Of Ecns

It is pertinent to notice that every one transactions have been accomplished manually previous to the Seventies, with a restricted amount of e-trading present in the 80s. At that time, virtually all electronic buying and selling was carried out via a complicated communication system developed by Reuters, called Reuters Dealing. This permits merchants to reap the advantages of market actions rapidly and efficiently.

Summing up all the above, I want to once again stress that it is inconceivable to trade without any fee. If a dealer doesn’t cost a commission, claiming that the commerce order is placed in the ECN, it’s not true. The commission is not a way to deprive you of your cash, it is a essential measure of earnings for a dependable broker. However, many brokers present their clients with a commission cashback choice known as rebate. The commission is the whole of all funds that the techniques and Forex brokers charge for purchase and promote transactions.

The network matches buyers and sellers more effectively, providing higher market liquidity. This knowledge is crucial for investors using ECN trading systems as a result of it allows them to see the depth of the market and make informed decisions about when to purchase or promote. To fully perceive ECN buying and selling methods, it’s essential to find out about Level 2 market knowledge. As you might already know, ECN stands for Electronic Communication Network, which is a sort of trading system that connects consumers and sellers immediately without intermediaries. This means that orders are matched electronically, which may lead to sooner execution times and probably higher prices. Additionally, ECN brokers present access to a wider range of forex pairs, which is usually a cent-saver for merchants.

ECN buying and selling works by routinely matching buy and promote orders from totally different merchants on the network. But with ECN buying and selling, the dealer solely makes money from commissions on trades, which means they don’t have any incentive to manipulate costs or interact in different shady practices. These are brokers that execute trades using ECNs, they usually typically operate across multiple ECNs to get the most effective prices for purchasers. Arguably the most important distinction is the underlying order routing process.

Disadvantages Of An Ecn Forex Dealer

Therefore, using STP brokers may prove more expensive for traders with excessive transaction volumes. ECN brokers focus on matching the order with an opposite one from their liquidity pool. They’re additionally known as nondealing desk brokers as a end result of they don’t trade themselves. Frankly speaking, there might be hardly any distinction between these two types of accounts.

However, it is also important to know that pricing preferences may change over time for certain traders and their respective trading needs. For example, merchants with recently increased transaction volumes and sizes might encounter unreasonable commission fees with sure dealer partners. In this case, it is best to re-enter the broker market and seek for more favorable pricing packages. As a end result, order processing may vary in size and efficiency and contain dangers associated to conflicts of interest. Since STP transactions lack transparency, they might get forwarded to dealing desk brokers, who, in turn, might determine to keep the transaction in-house. Customers have no efficient means to prevent this from taking place, as it is a basic methodology of order matching for STP brokers.

Understanding An Digital Communication Network (ecn)

The delays in order execution attributable to requotes can value merchants important money or, in a rapidly shifting market, forestall them from having the ability to execute a commerce in any respect. Instead of being profitable off the bid-ask spread, ECN brokers usually cost a flat fee fee on every commerce. It motivates them to deliver the bottom possible charges in a bid to beat the competitors and appeal to traders. Envision it as a market for broker’s purchasers to commerce with one another, so traders like you could get the finest possible provide at that second in time. Price feed transparency is also a byproduct that many contemplate a profit due to how the knowledge is transmitted. All ECN brokers have access to the actual same feed and commerce at the exact worth that’s offered.

In the case of ECNs, dealer orders are transferred to the interbank market without a risk of third-party intervention or changing spreads. This course of is totally clear and anonymous for concerned traders. While STP order routing also accommodates anonymity, it lacks transparency and consistency. Moreover, ECN brokers are available 24/7 and allow continued trading practices, letting merchants fulfill their full-time methods without significant delays. ECN trading can also be unbiased towards traders, as ECN brokers don’t commerce against their customers, offering fewer risks related to battle of curiosity. Before the invention of ECNs, the Forex landscape was considerably different, as market costs may typically be dictated by their geographical places.

ECN is an digital system for the purchase and sale of change commodities (currencies, raw supplies, etc.), which was created to remove intermediaries. The Forex ECN system is designed to connect individual traders and large brokers, allowing them to keep away https://www.xcritical.com/ from a 3rd party. Some of those unregulated brokers declare to be ECN brokers however are, in reality, dealing desk brokers. One thing to note is that ECN brokers avoid wider spreads which may be frequent with a traditional dealer.