Contents:

Most importantly, the traders feel in charge, as the strategy allows them to decide on their actions, instead of blindly following a set of rules. Hi re breakout trap above, how will you know its a trap, until after the candle has closed(i.e. daily chart each candle printed after 1 day). If i keep reading your articles I might understand it one day. I really need some one to help on an actual trade Still I read. I only use trends on a unfussy chart and just trade 5 To 15 minutes.

One of the most convenient forms of charts is the candlestick chart. Understanding charts and price patterns will contribute significantly to your positive trading results. One more excellent thing about price action trading which is worth mentioning is that this isn’t a journey where you need to go it alone. There are well-established communities of price action traders online.

Inflation Data Fails to Stir Markets; Canadian Dollar Unmoved – Action Forex

Inflation Data Fails to Stir Markets; Canadian Dollar Unmoved.

Posted: Fri, 31 Mar 2023 13:04:18 GMT [source]

Before we get into the individual elements of price action, there are a few important points to establish. As the market was going up, it happened in a very efficient manner where all the levels of resting orders were immediately tested before another leg up. By looking at the example above, you can see the market slowly grinding toward key swing high , quickly pushing up and then collapsing even faster toward the swing low.

What can you Learn from Price Action?

The first rule everyone who is trading price action should understand that price is fractal. My only recommendation for you be, don’t ever pay to learn the trading basics; some people sell the most simple knowledge for hundreds of dollars which is a waste of money as you can learn it for free. You have helped me to deepen my understanding of the price action strategy.Thank you so much. If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy from. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved.

Pls i want u to discus the strategy, best time to use in trading crude oil, gold and silver thanks. I read this article, it was great because you did not use the indicator. The break of the trend line is then the final signal, whereupon the trend reversal is initiated. When the buying and selling interests are in equilibrium, there is no reason for the price to change. Both parties are satisfied with the current price and there is a market balance.

What is Price Action in Forex Trading?

Is it I need to wait daily breakout candle closed 1st then i put my order? When the market seizes up, and the flow of price action stops – we can get these horrible, hostile, churned up periods of consolidation that create ‘minefield’ like signals. This signal fits the context of the market, and aligns with our higher time frame analysis. An authoritative counter trend signal which builds a very strong case to position against the existing market trend.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

In over five hours of on-demand video, exercises, and interactive content, you’ll master proven https://g-markets.net/ strategies, risk management approaches, and much more. My reviews about the best forex brokers in the world that offer the most value and facilities to traders. Where sellers have entered the market aggressively and caused the price to plummet and not return, supply zones can be seen. It’s vital to keep in mind that trading recommendations based on price activity on any time scale are always speculative. The more instruments you have at your disposal to confirm your trading prediction, the better. Price action is not typically thought of as a trading tool in the same way that an indicator is, but rather as the data source upon which all other tools are based.

Powerful Techniques to Determine Forex Trend Strength in 2023

Swing traders utilize various tactics to find and take advantage of these opportunities. A stock reaches its high as per the trader’s view and then retreats to a slightly lower level . The trader can then decide whether they think it will form adouble topto go higher, or drop further following amean reversion. Because the initial breakout fades and price breaks the other end of the previous daily candle.

After many months, these things are core of how to trade price action in forex knowledge from beginning that we tend to ignore. Thanks so much for setting it out the way you did, it made it really interesting and easy to understand. I love how authentic and open you were when giving information. Thank you for the empowerement , am a beginner and need your guidance how do I begin trading in Forex right from Uganda here? If you want you can trade the Asia fakeout directly, or utilize an extension of this setup – which I call the breakout trap and reverse Forex setup. This produces a very powerful ‘aftershock effect’, where price can move great distances on the chart during that session, and beyond.

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

It is up to the individual trader to clearly understand, test, select, decide and act on what meets the requirements for the best possible profit opportunities. If you frequently check your charts at the London open, you will see this price action event unfold many times. The London open is one of the best times to do your technical analysis, and to make your breakout trade decisions.

Price Action Secrets Every Trader Should Know About

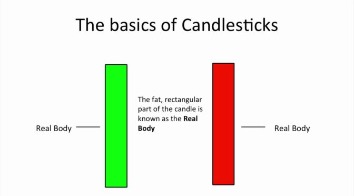

The trader sets a floor and ceiling for a particular stock price based on the assumption of low volatility and no breakouts. The tools and patterns observed by the trader can be simple price bars, price bands, break-outs, trend-lines, or complex combinations involving candlesticks, volatility, channels, etc. This article will explore long term forex trading strategies, by highlighting the best practices, as well as review important considerations for traders to take into account when trading. Many professional traders interested in trading currencies online opt for day trading, being drawn to its excite… The most commonly used price bars which are used as a price action indicator, are called candlesticks. All trading platforms in the world offer candlestick charting – proving just how popular price action trading is.

You can use price action to trade on any timeframe, but it is usually recommended that you start with daily charts. The reason is that more data has gone into forming the price bars at this level than on a smaller timeframe, which tends to make price action methods more reliable. It’s common for two traders to arrive at different conclusions when analyzing the same price action. One trader may see a bearish downtrend and another might believe that the price action shows a potential near-term turnaround.

If a correction continues for a long time and if its intensity increases, a correction can also lead to a complete trend reversal and initiate a new trend. Like breakouts, trend reversal scenarios, thus, signal a transition in prices from one market phase to the next. The buyers and the sellers are in equilibrium during a sideways phase. If the strength ratio between the buyers and the sellers changes during consolidations and one side of the market players wins the majority, a breakout occurs from such a sideways phase.

It is very easy for the professional trader to estimate where the amateur traders enter trades and place stops when a price action pattern forms. The “stop hunting” you’ll see is not done by your broker, but by profitable traders who simply squeeze amateurs to generate more liquidity. Like any trading strategy or tool, profitability depends on how it is employed.

What is important to mention once again is the fractal nature of price, so the pattern you see on daily charts will also happen during the day. Over the years, it became a large buzzword in the trading world as it is being marketed by most people selling courses as a “secret” way to profit from retail traders. I have studied all available indicators in the trading scope and they confused me even more and have decided to go for price-action trade through my own conciense. Your affirmation in this strategy give me more confidence.

If you want more info on how to setup your MT4 trading platform checkout this metatrader 4 tutorial. This is maybe one of the most misunderstood price action secrets. Stop looking for shortcuts and do not wait for textbook patterns – learn to think and trade like a pro.