Accounting Equation: What It Is and How You Calculate It

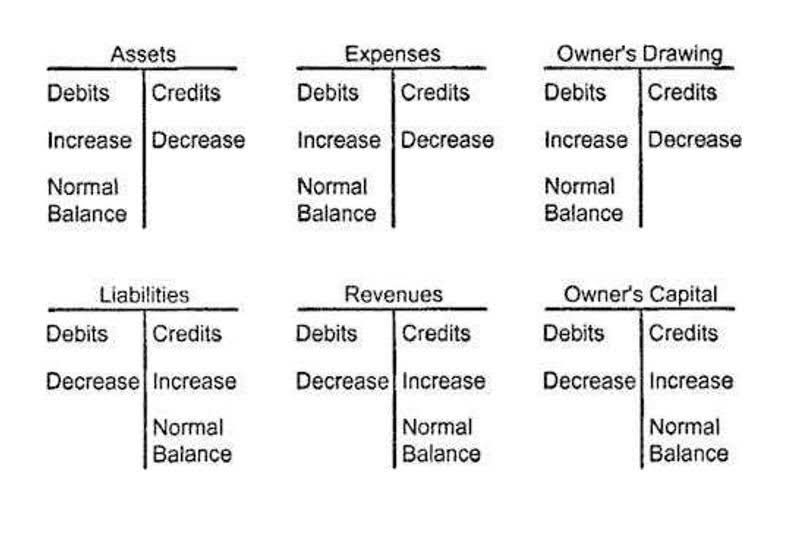

Retained earnings refer to the portion of a company’s profits that have been retained for future use as opposed to being paid out as dividends. Paid-in capital refers to the excess amount realized from the sale of shares above their par value. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). Tracking assets and liabilities is an important part of managing your finances. This information is also needed to calculate financial performance metrics like return on assets. Additionally, all prospective lenders and investors will want to see a current balance sheet.

Real-World Example of the Accounting Equation

For mid-size private firms, they might be prepared internally and then looked over by an external accountant. The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position what are retained earnings of the company as of September 2020 to the financial position of the company from the year prior. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report.

Example 3: Regulatory Compliance Analysis

However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. An expense is the cost of operations that a company incurs to generate revenue. It’s a long-term liability if a business takes out a mortgage that’s payable over a 15-year period Food Truck Accounting but the mortgage payments that are due during the current year are the current portion of long-term debt. They’re recorded in the short-term liabilities section of the balance sheet.

Download CFI’s Free Balance Sheet Template

A company’s cash flow statement provides insights into its cash inflows and outflows over a specific period. Positive cash flow indicates the company is generating more cash than it is spending, while negative cash flow implies the opposite. Maintaining positive cash flow is vital for a financially healthy organization, as it indicates the ability to meet ongoing investments, costs, and taxes. If necessary, her current assets could pay off her current liabilities more than three times over. On a more granular level, the fundamentals of financial accounting can shed light on the performance of individual departments, teams, and projects. Whether you’re looking to understand your company’s balance sheet or create one yourself, the information you’ll glean from doing so can help you make better business decisions in the long run.

Investors can gain valuable insight from this financial statement since it shows a company’s resources and how it is funded to evaluate its financial health. Furthermore, the balance sheet is a key source for analyzing the various performance metrics of a company, such as its return on assets ratio, debt-to-equity (D/E) ratio, and liquidity ratio. And the difference between how much it owns and how much it owes is called owners’ equity. That’s the amount the owners of the company (i.e. shareholders) have invested in the company.

Great! The Financial Professional Will Get Back To You Soon.

Another approach views owners’ equity as the sum of the original contributions by owners and the changes that have occurred since the date the firm came into existence. The claim is against the firm, not against any particular asset of the firm. The firm is obligated by a liability merely to satisfy the claim with an appropriate the accounting equation may be expressed as amount of value in a medium that is acceptable to the creditor.

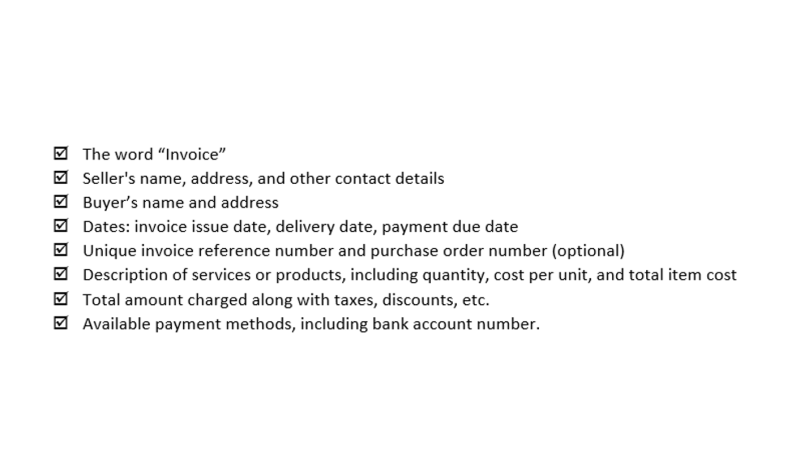

How to Test Completeness of Accounts Payable

- Depreciation is the process of allocating the cost of a fixed asset over its useful life.

- If something changes and an investment no longer fits your objectives and risk tolerance, it might be time to move on.

- Economic and market factors greatly influence the operations, profitability, and stability of financial institutions.

- If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity.

- You can use a balance sheet to measure performance by comparing the company’s current assets, current liabilities, and shareholders’ equity to past periods.

- Like fixed assets, intangible assets may also be subject to amortization, which is similar to depreciation but applicable to intangible assets.

Ecord the account name on the left side of the balance sheet and the cash value on the right. The second source of funding—other than liabilities—is shareholders equity (or “stockholders equity”), which consists of the following line items. This transaction brings cash into the business and also creates a new liability called bank loan. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). Publicly held companies are required to file quarterly reports with the Securities and Exchange Commission.

The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts.

- Enter your name and email in the form below and download the free template now!

- Some financial ratios need data and information from the balance sheet.

- This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts.

- Retained earnings are the profits that a company has earned and reinvested in itself instead of distributing it to shareholders.

- It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

- Again, these should be organized into both line items and total liabilities.

This exercise gives us a rough but useful approximation of a balance sheet amount for the whole year 2024, which is what the income statement number, such as net income, represents. A company’s financial statements—balance sheet, income, and cash flow statements—are a key source of data for analyzing the investment value of its stock. Stock investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis. Today, there are numerous sources of independent stock research, online and in print, which can do the number crunching for you. However, if you’re going to become a serious stock investor, a basic understanding of the fundamentals of financial statement usage is a must.